FlexiFonds funds returns

Save while supporting local businesses.

Annual compound returns (%) as of January 31, 2026*

| Year to Date | 1 year | 3 years | 5 years | 10 years | Since Inception | |

|---|---|---|---|---|---|---|

| FlexiFonds Conservative | 0.19% | 4.01% | 5.52% | 2.38% | N/A | 3.35% |

| FlexiFonds Balanced | -0.06% | 6.02% | 7.58% | 4.21% | N/A | 4.97% |

| FlexiFonds Growth | -0.21% | 8.37% | 9.56% | 6.15% | N/A | 6.86% |

Legal notice

Management fees and other expenses may be associated with mutual fund investments. Please consult your advisor and read the prospectus and the fund facts documents before making an investment. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The FlexiFonds funds are not guaranteed, their values change frequently, and past performance may not be repeated.

How much is a FlexiFonds mutual fund advisor worth?

As an investor, you may be tempted to deviate from your long-term savings objectives. You could, for instance, be seduced by attractive short-term rates or tempted to liquidate everything at the next market tremor. That's where the FlexiFonds team comes in, to help you make decisions that are in your best interest. According to a Quebec study conducted by CIRANO, using financial advice could enable you to accumulate nearly 3 times more savings than if you were to invest on your own for retirement.

What our savers say

"Customer service is always really good. The advisor was very pleasant and her level of expertise and skills were frankly reassuring and make me want to continue investing with the Fonds."

— Martine, FlexiFonds saver

"The advisor was very attentive to my needs, very professional and I could feel the smile in her voice!"

— Marie-Josée, FlexiFonds saver

Investing with FlexiFonds products is a great way to keep your savings local!

Seventy percent of the Fonds' assets are related to the local economy, 30% of which are made up of Fonds de solidarité FTQ shares that are directly reinvested in Québec companies.

Fonds de solidarité FTQ shares

Their value is published about December 23 and June 23 each year.

Québec stocks

Their value changes every day, depending on the markets.

Global equities

Their value changes every day, depending on the markets.

Fixed income securities

Their value changes every day, depending on the markets.

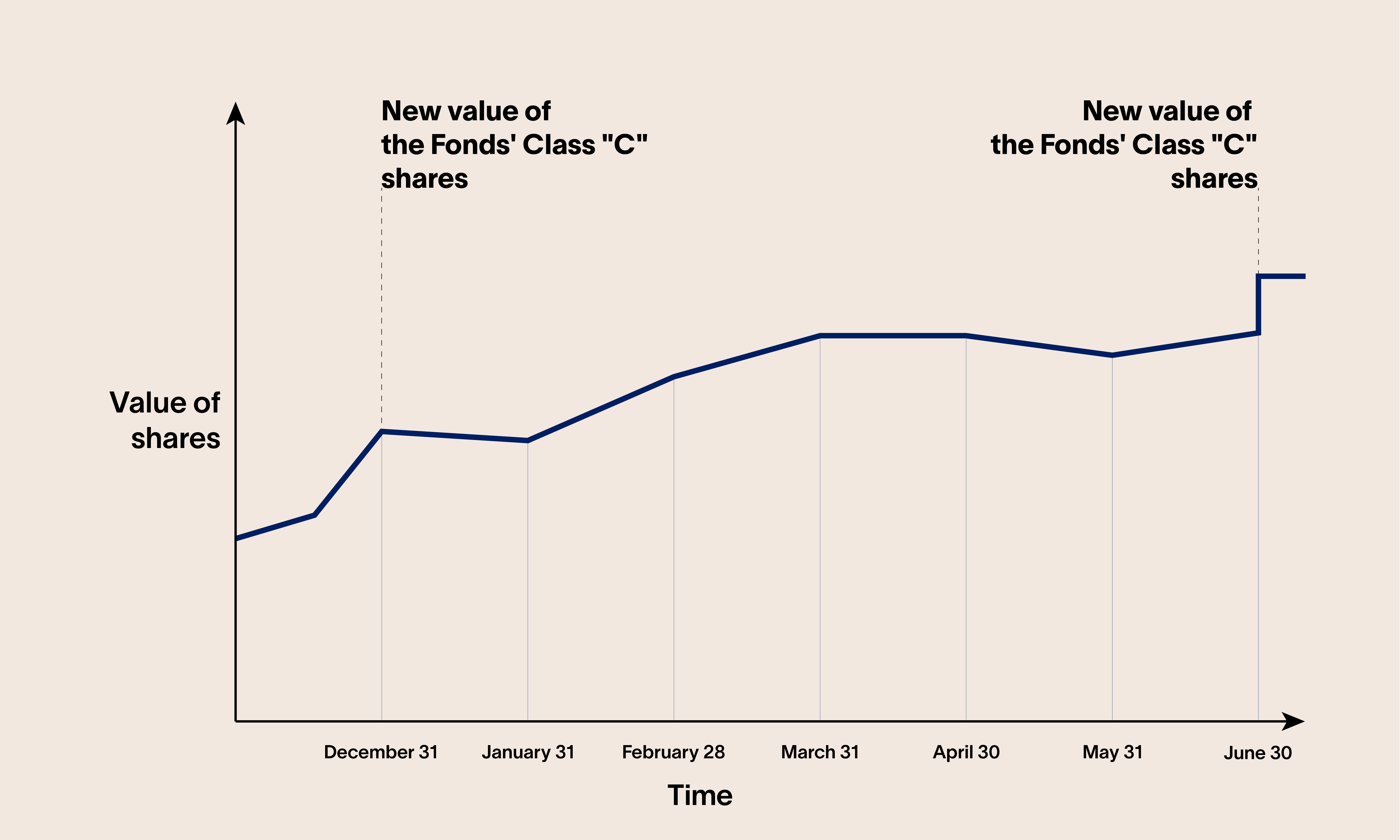

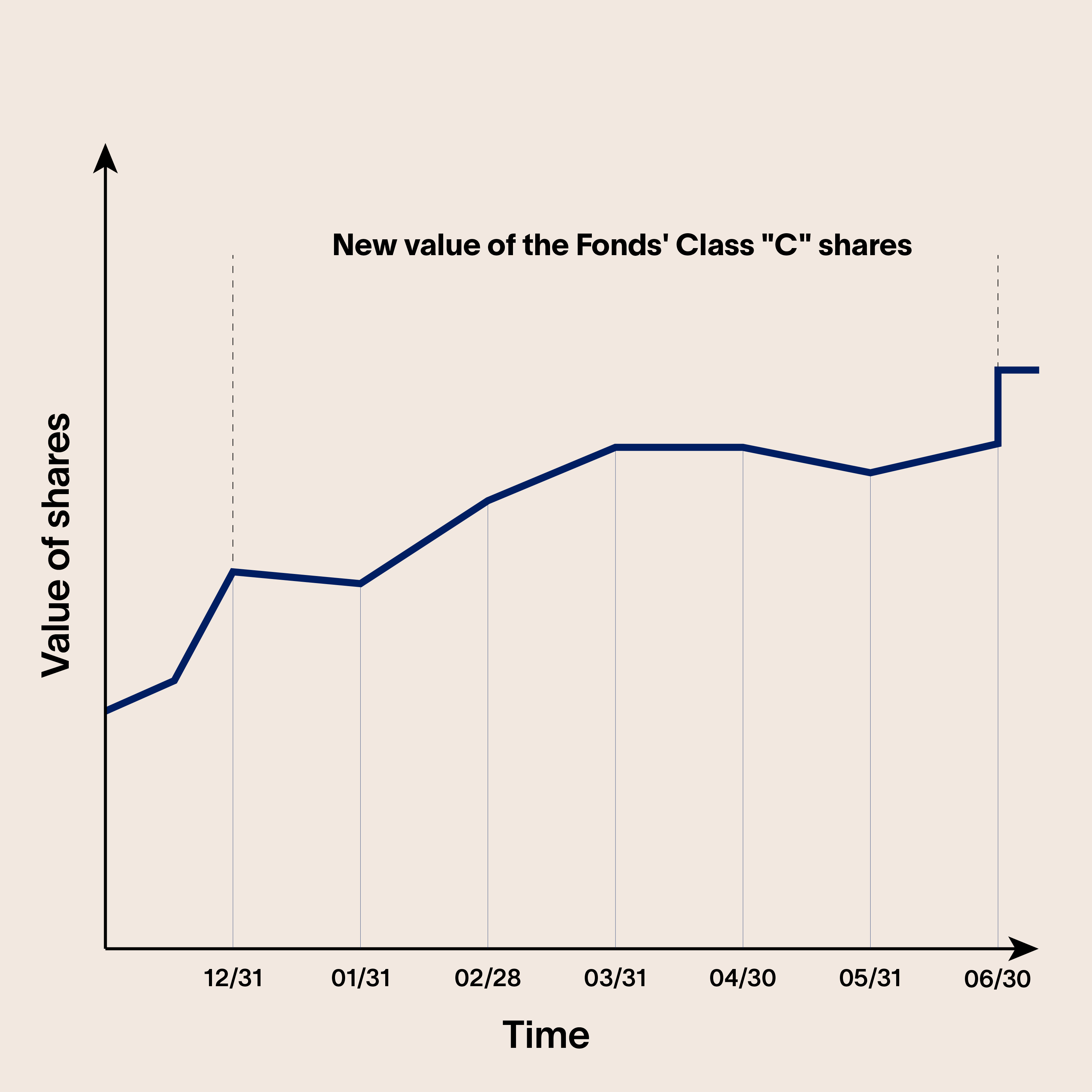

A two-tiered variation

A portion of the FlexiFonds portfolio varies every day: This includes stocks and bonds, which make up 70% of the funds' mix.

The other portion only changes twice a year: The value of Fonds shares, which make up 30% of the funds, is usually only determined twice a year. This is the only time when they might impact the value of fund units.

How does this two-tiered variation affect your savings?

Daily fluctuations of FlexiFonds funds may be less significant than those of other mutual funds, whereas changes in the value of Fonds FTQ shares in June and December will have a greater impact on their value.

Because Fonds' shares can yield a positive return while the markets are down and vice versa, it's crucial to analyze the performance of FlexiFonds portfolios over time, i.e., over several years.

About FlexiFonds de solidarité FTQ

FlexiFonds de solidarité FTQ inc., a wholly owned subsidiary of the Fonds de solidarité FTQ, is a mutual fund dealer duly registered with the Autorité des marchés financiers. FlexiFonds de solidarité inc. acts as the principal distributor of the FlexiFonds funds and does not distribute the units of any other mutual fund.

Most frequently asked questions