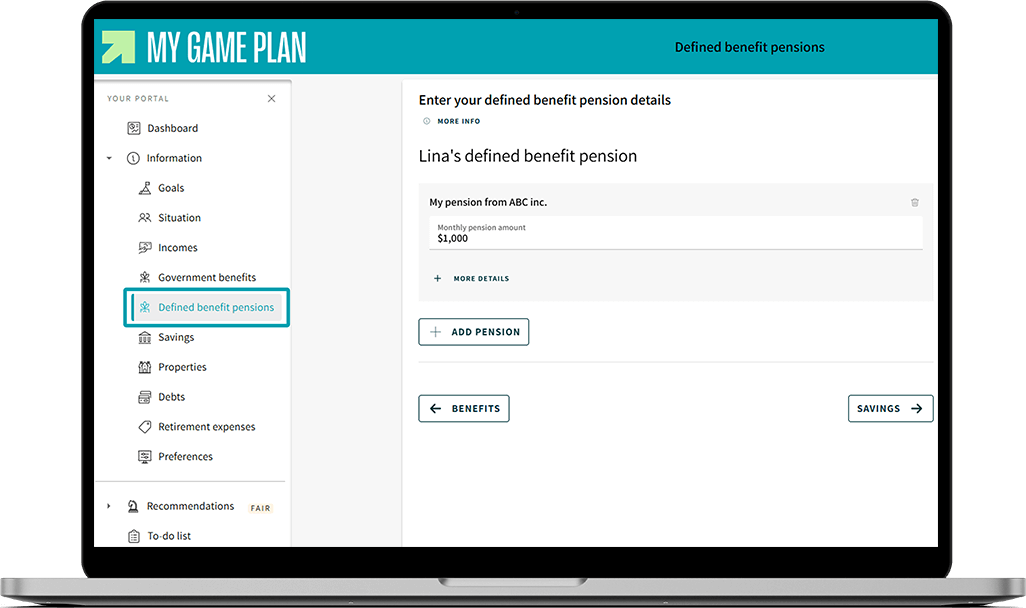

To project your retirement income as accurately as possible, you need to enter up-to-date information about your pension plans. Have your most recent pension statement handy—it'll be very useful!

Do you have a defined benefit pension plan?

Enter the data in the section titled Defined Benefit Pensions.

A defined benefit pension plan guarantees you a fixed monthly income in retirement, paid for life. The amount of the pension is based on several factors, such as:

- Your years of service

- Your average salary

- A fixed percentage

- Indexation to inflation

×

The RREGOP (Government and Public Employees Retirement Plan) and the PPMP (Pension Plan for Management Personnel), for example, are defined benefit plans.

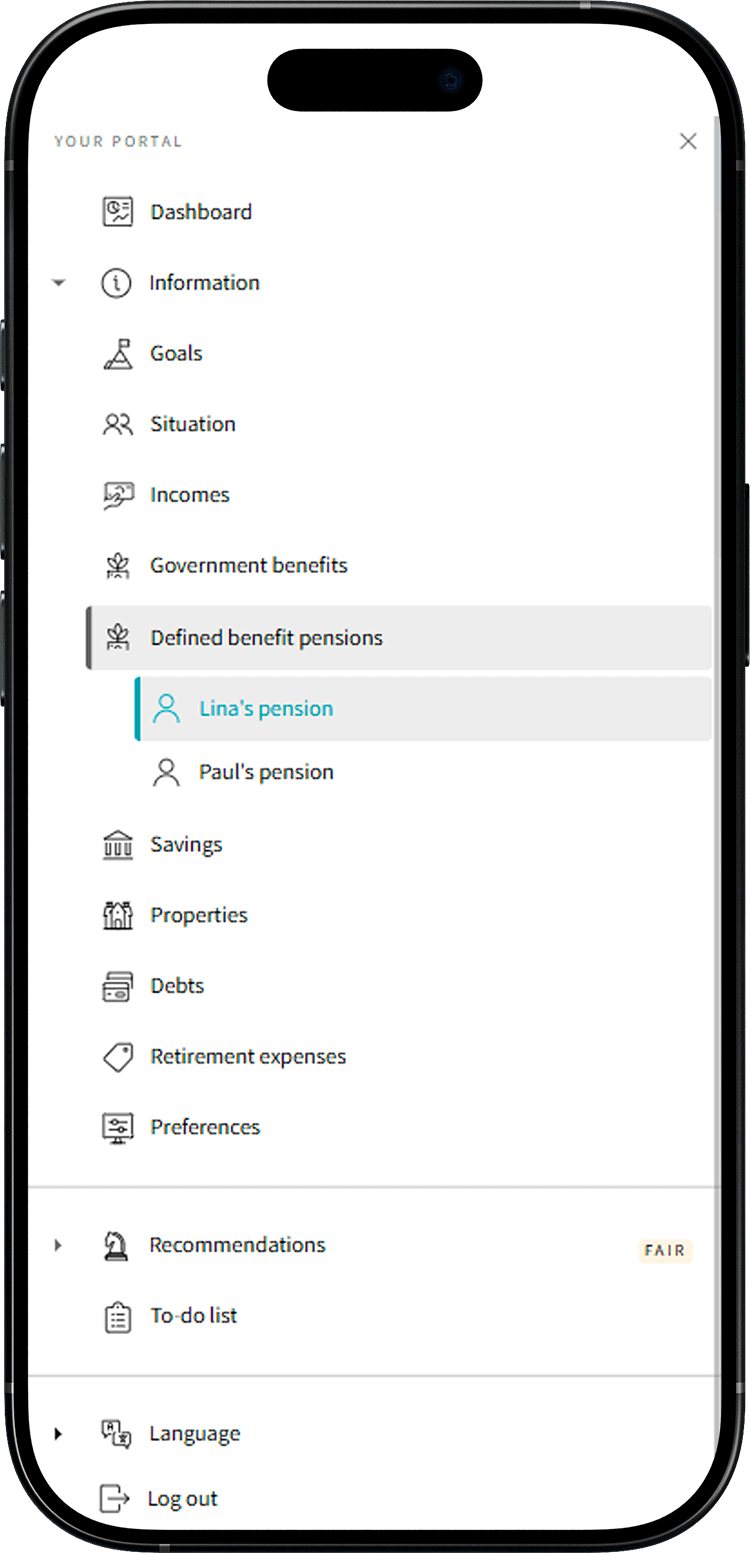

Do you have another type of pension plan?

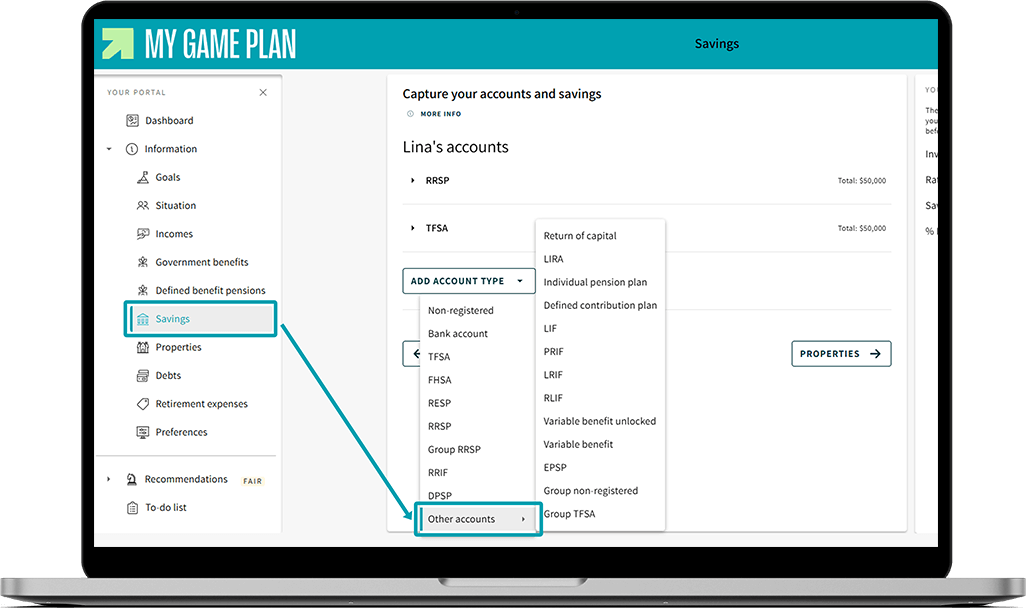

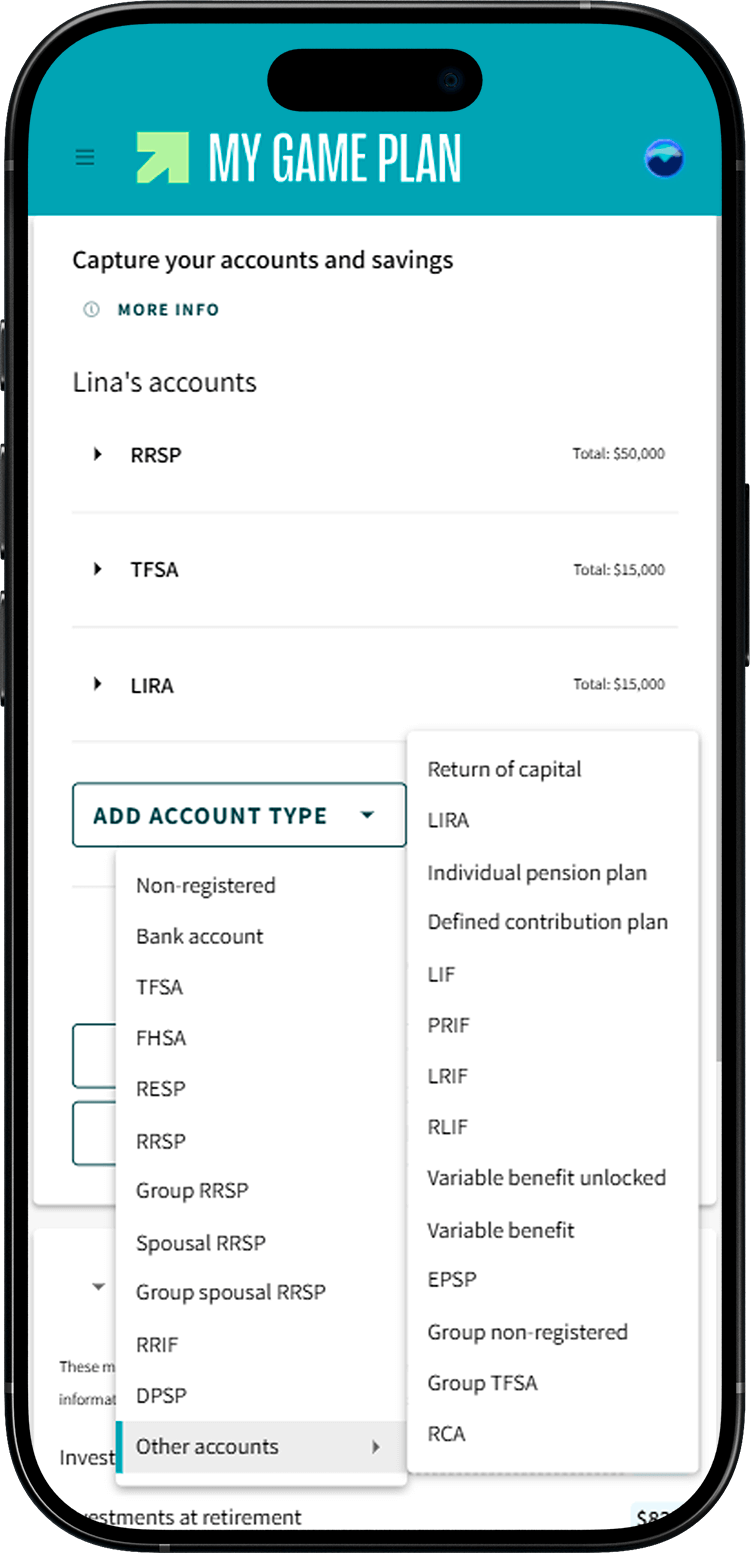

To enter it in My Game Plan:

- Go to the Savings section.

- Click on Add account type.

- Select the pension plan to add. If needed, select Other accounts to access more options.

×

Here are the most common types of plans you can add:

- Defined Contribution Plan. A plan where you contribute a fixed amount, but the pension you receive at retirement may vary. It depends on the contributions made by you and your employer, investment returns, and management fees. Check your annual statement for an estimate of your pension amount.

- Group RRSP. A registered retirement savings plan set up by your employer, pooling contributions from multiple employees.

- Spousal Group RRSP. A plan set up by an employer where a taxpayer contributes to their spouse's RRSP.

- DPSP (Deferred Profit Sharing Plan). This plan allows the company to share part of its profits with employees, without requiring them to contribute.

Enter other savings from former pension plans, if applicable:

- LIRA (Locked-In Retirement Account). A LIRA allows you to transfer funds from a pension plan or retirement plan from a former employer into an individual plan. The funds continue to grow tax-free until retirement.

- LIF (Life Income Fund). A LIF is a registered fund that extends a LIRA when you're ready to start withdrawing, no later than age 71. Funds in a LIF continue to grow tax-free until withdrawn.

- RLIF (Restricted Life Income Fund). A type of LIF that applies to federal pension plans (e.g., from a job in a bank, railway company, or the federal government).

Other, less common plans may apply in specific cases:

- IPP (Individual Pension Plan). Designed for business owners or professionals who have already maximized their RRSP or TFSA contributions and want to continue saving for retirement.

- EPSP (Employee Profit Sharing Plan). Similar to a DPSP, this type of plan allows employees to receive a share of company profits as a deposit into a personal account, usually once a year.

- Variable Benefit. A withdrawal option often associated with a defined contribution plan. It works similarly to a LIF and withdrawals are subject to certain rules. When withdrawal rules are relaxed, it's called an unlocked variable benefit.

- Non-registered group plan. This category includes any employer-sponsored pension plan that is not registered with the federal government. It's also called a NRSP (Non-Registered Savings Plan).

- Return of capital. Some types of investment funds allow you to recover part of your invested capital to generate regular income. This strategy can be tax-efficient for supplementing retirement income.

Finally, if you've worked in another Canadian province, you may have one of the following funds:

- PRIF (Prescribed Retirement Income Fund)

- LRIF (Locked-In Retirement Income Fund)