At retirement, you'll receive a basic income from the government through two benefits: the Québec Pension Plan (QPP) benefit and Canada's Old Age Security (OAS) benefit.

My Game Plan shows a default amount for these benefits. This general estimate is based on data that applies to a large portion of the population.

However, to build a more personalized financial plan, you can adjust the amount of your benefits.

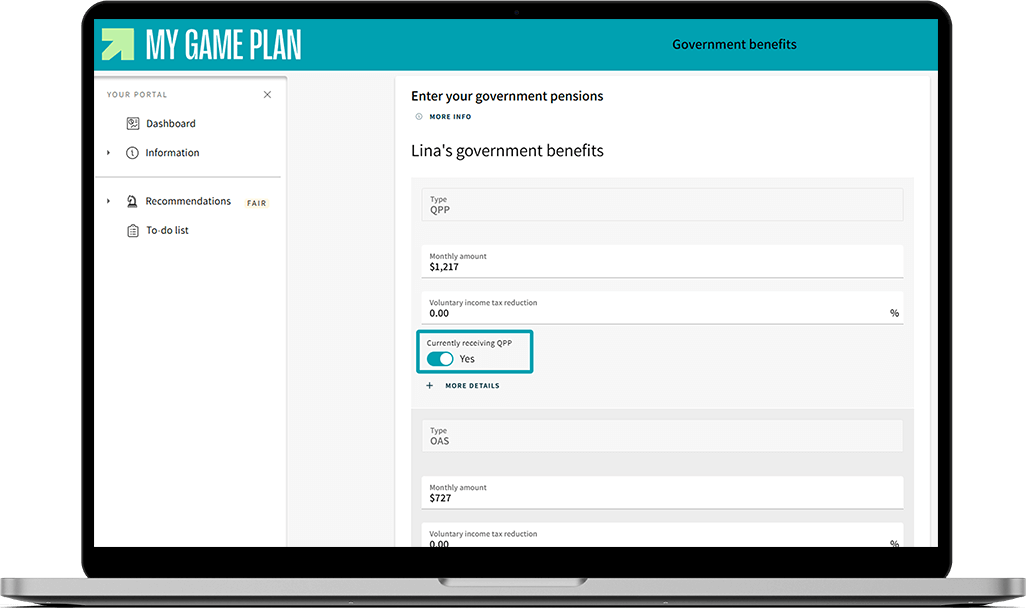

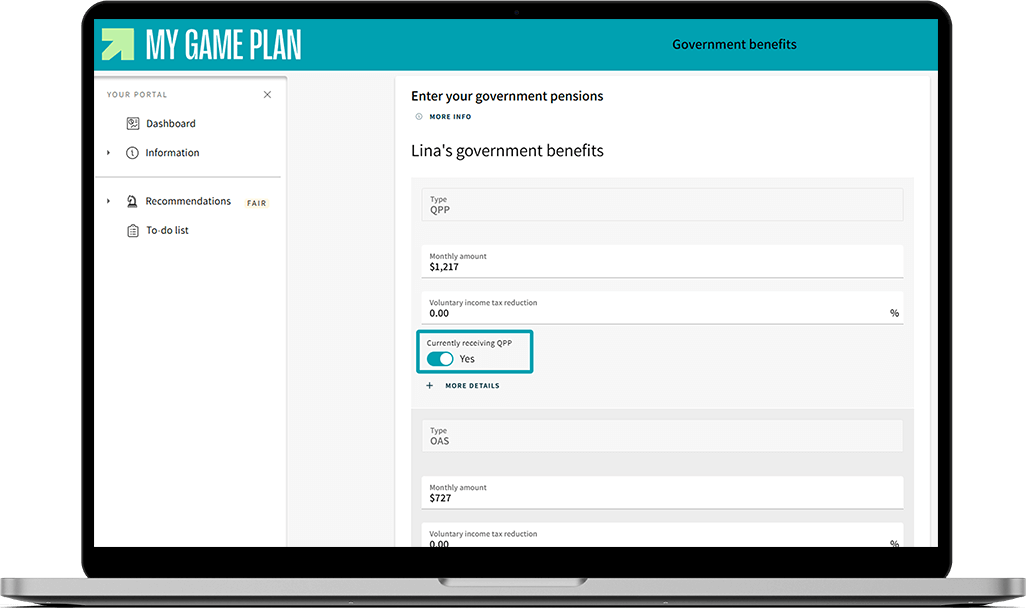

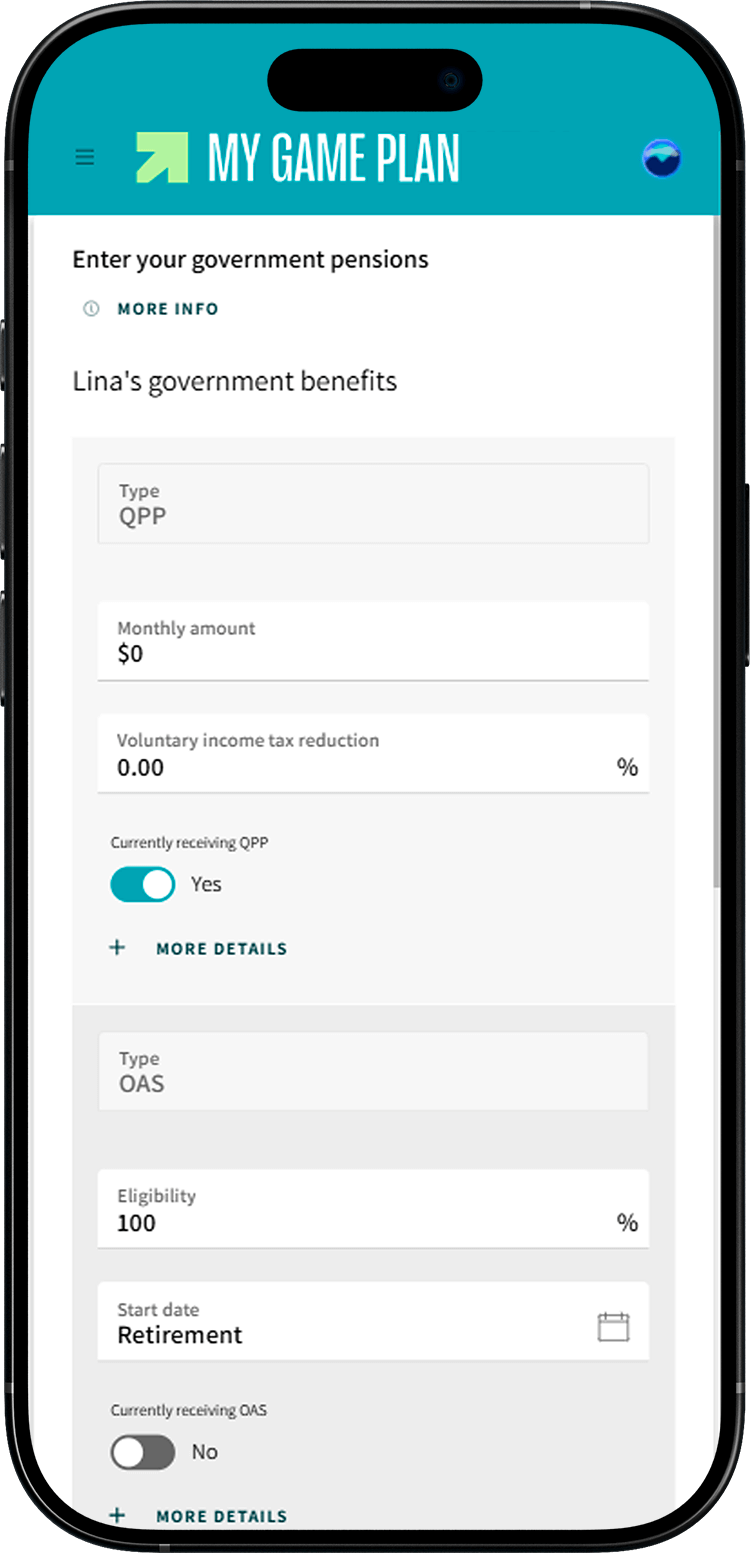

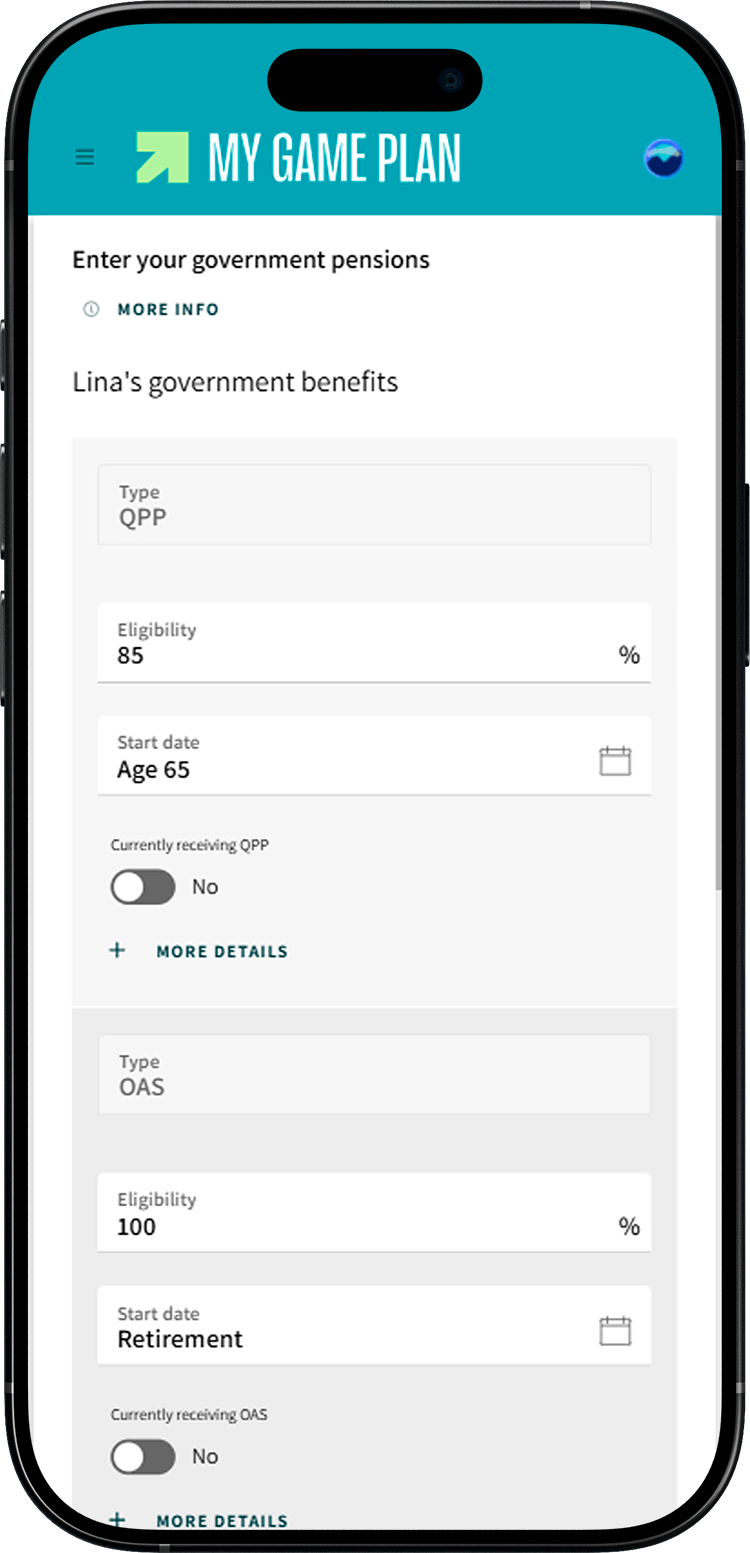

Already retired and receiving your government benefits?

Enter the amounts you receive in My Game Plan:

- Go to the Government benefits section.

- Activate the switch Currently receiving QPP or Currently receiving OAS.

- Enter your benefit amount in the Monthly amount field.

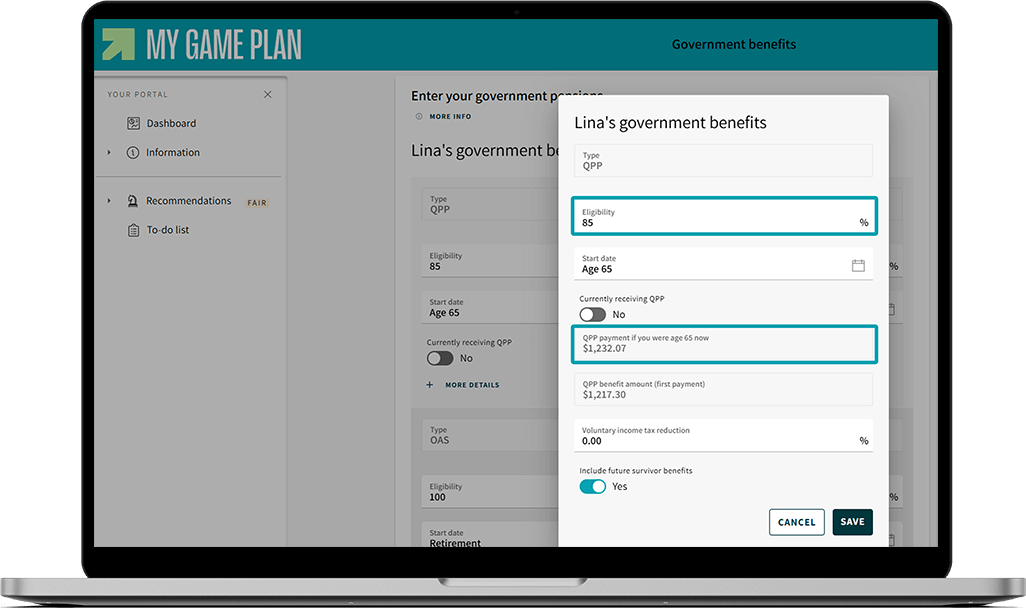

How to adjust your QPP pension

- In your Retraite Québec online account, check your Statement of Participation. There you'll find the projected amount of your pension if you retire at age 65. Make note of this amount.

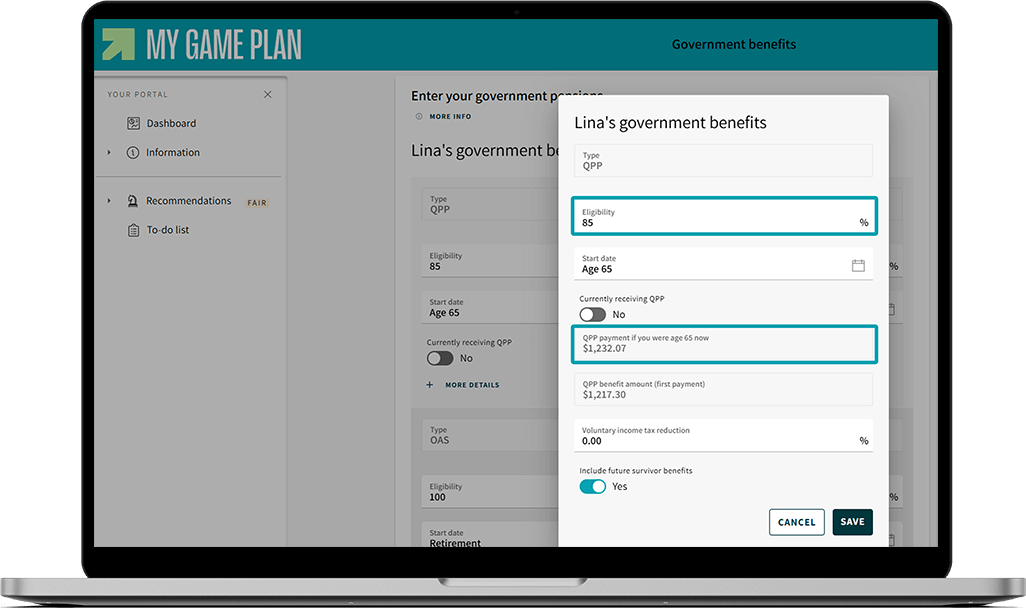

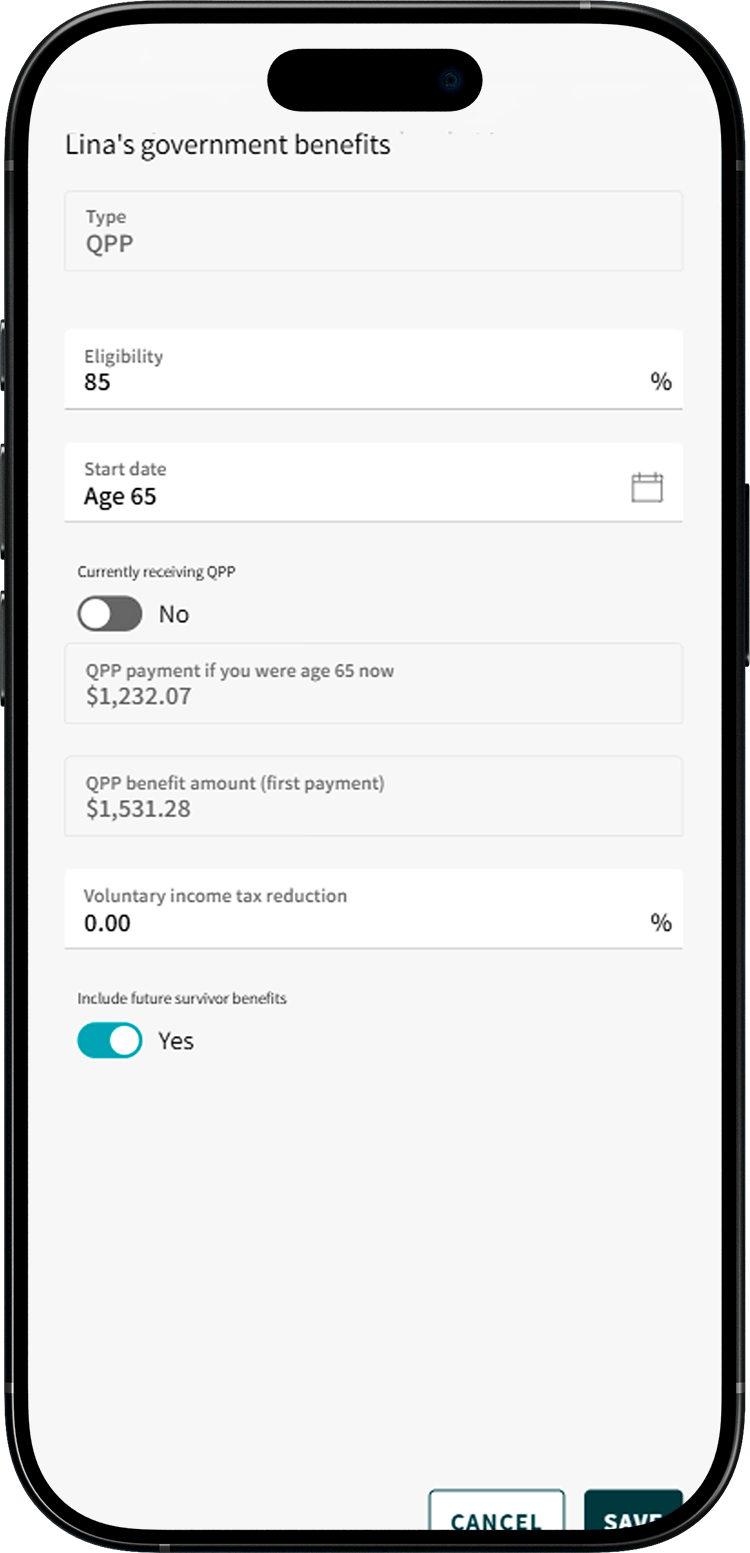

- In the Government benefits > QPP section of My Game Plan, click More details.

- Adjust the eligibility percentage until the projected pension amount matches the value shown in the QPP payment if you were 65 now field.

- Update the Start date field if needed. Delaying your pension can often be a smart choice. Learn more.

Why is the default eligibility rate 85%?

To receive 100% of the planned QPP pension amount, a person would need to have earned at least the maximum pensionable earnings starting at age 18. However, most people don't reach this maximum early in adulthood. Life events can also reduce earnings during a career. That's why, on average, a person is estimated to receive 85% of the planned pension amount if retiring at age 65.

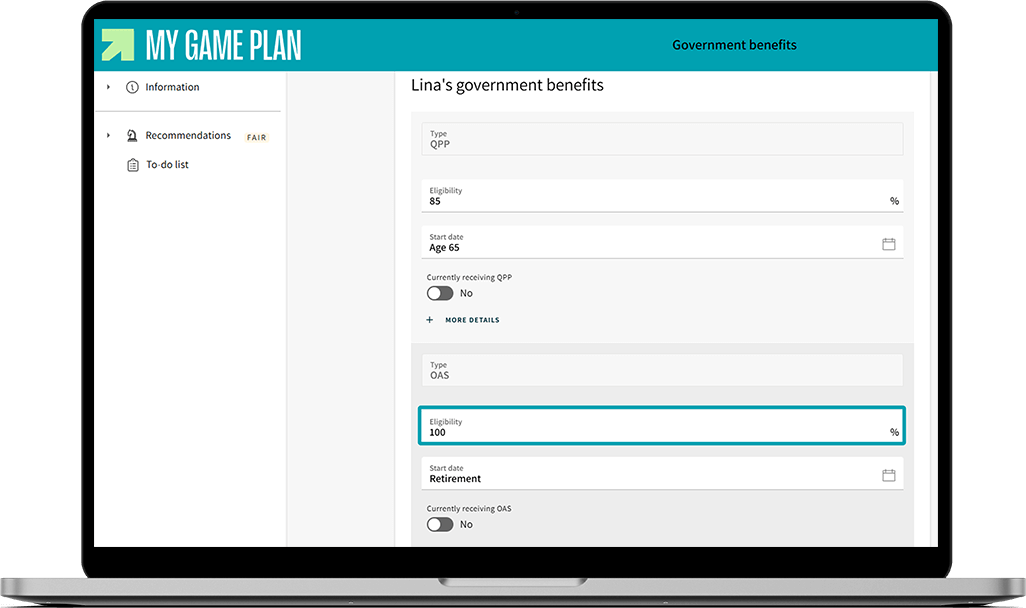

How to adjust your OAS benefit

The amount of your Old Age Security (OAS) benefit depends on the number of years you've lived in Canada. You must have lived in Canada for at least 40 years after age 18 to receive 100% of the pension.

If you've lived in Canada for less than 40 years after age 18, adjust the rate as follows:

- Go to the Government benefits > OAS section.

- Change the eligibility percentage based on the number of years you've lived in Canada after age 18. For example, someone who lived in Canada for 30 years would receive 75% of the OAS benefit (30 divided by 40).

Note: The estimated OAS amount in My Game Plan does not include the Guaranteed Income Supplement, if you qualify for it.

For a more accurate estimate of your Old Age Security benefits at retirement, you can use the Government of Canada's calculation tool.

A projection that keeps up with the cost of living

Government benefits increase each year based on the cost of living. The projections in My Game Plan take this increase into account. The amount shown in the First payment field is therefore an estimate of what you should receive in the year you apply for your benefit.