8 financial tips to adopt in times of economic turbulence

ReadWe explain why it's important to stay focused on your savings goals despite the current economic context.

In times of geopolitical uncertainty and market volatility, it isn't always easy to keep your cool and stay focused on your savings goals. Here at the Fonds, we are committed to helping you manage your savings and make informed decisions.

The current economic context may seem worrying, but it's normal for your investments to fluctuate when you have medium- or long-term savings goals. However, we know from historical precedent that downturns are generally followed by a strong recovery.

Depending on your savings goals, staying invested is generally the best long-term solution.

At the Fonds, the management structure of our portfolio was designed to make it more resilient in volatile periods, such as the one we've been experiencing since early March. This means that, generally speaking, the distribution of our assets makes the Fonds returns less volatile than those of the stock markets.

Be sure to take into account your savings' investment horizon.

Read our file on keeping a cool head and making good savings decisions.

Make sure you have the right disbursement strategy. Our FlexiFonds advisory team is here to help with no pressure or commission.

If you withdraw all or part of your savings from the Fonds in anticipation of retirement, you will no longer be eligible for the 30% in tax credits[1] for the year of withdrawal. Keep in mind that this represents an additional tax savings of up to $1,500 per year until the end of the fiscal year in which you turn 64. Think carefully before making a decision!

Our diversified portfolio enables us to adapt and remain focused on the long term in order to achieve a reasonable return. Our unique model puts your savings to work in the local economy and saves jobs.

In this climate of economic uncertainty, your savings with the Fonds have never been more important for Québec. The Fonds is the largest development capital investment network in Québec. When you save for your retirement with the Fonds, your money is invested primarily in Québec companies operating in a wide range of sectors across all regions of the province. Thus, your savings stimulate wealth creation right here in Québec.

FlexiFonds funds target an asset mix with 70% of assets related to the Québec economy. Of this percentage, each fund aims to invest 30%[1] of its assets in Fonds de solidarité FTQ shares. This asset mix supports our mission and our local economy while offering a degree of stability in uncertain times.

At the Fonds, 65% of our portfolio supports local businesses, so that they can continue to grow right here in Quebec. The vast majority of these investments are protected from market fluctuations and are therefore less volatile.

The other 35% is diversified, with exposure to stock markets (shares) and fixed-income securities (bonds), which react differently to market movements.

When the markets are down, the most important thing is to avoid letting your emotions dictate your financial decisions. Try to think rationally and remember that decisions made in the wake of a sharp downturn may cost you in the long run. In a bear market, selling often means taking a loss. Our FlexiFonds mutual fund advisors are just a phone call away and can help you manage your FlexiFonds investments. With their advice and expertise, you can avoid making choices that will cost you more than you think.

If you withdraw all or part of your savings from the Fonds in anticipation of retirement, you will no longer be eligible for the 30%[1] in tax credits for the year of withdrawal. Keep in mind that this represents an additional tax savings of up to $1,500 per year until the end of the tax year in which you turn 64.

With life expectancy approaching 90 for Québecers, your retirement could last 30 years! With this in mind, it may be wise to keep a long-term perspective on some of your investments. However, if you must use your savings in the short term, you may need to withdraw them from the markets. This is where a good disbursement strategy comes in. Contact our FlexiFonds advisory team to make your plan.

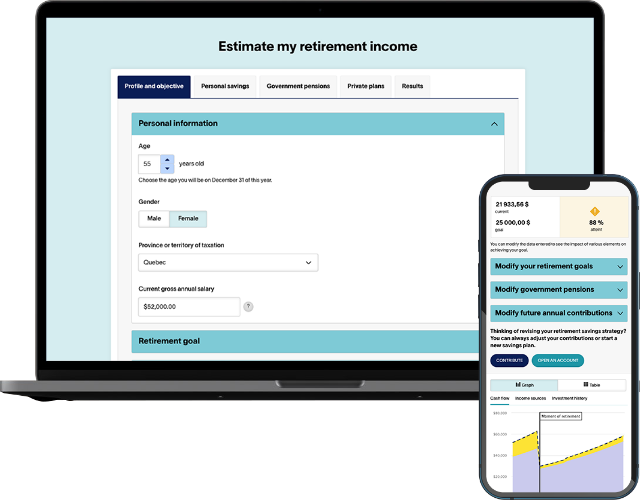

Whether you're ahead of the game or think you've fallen behind in your retirement planning, you can use our online tool to test different scenarios and start building a solid plan.

FlexiFonds mutual fund advisor and financial planner Sébastien Lafontaine is an expert with our retirement income calculator. Using the case of a saver 10 years from retirement, we provide an overview of the tool and what makes it so useful.

Would you like to review your retirement plan or disbursement strategy? We can help you stay on track and avoid making hasty decisions that could get in the way of your savings goals.

Call the FlexiFonds Advisory Centre at 1-833-383-2121

Monday to Thursday, from 9 a.m. to 8 p.m., and Fridays from 9 a.m. to 5 p.m.

The subscription for shares of the Fonds de solidarité FTQ may give rise to labour-sponsored fund tax credits. The tax credits amount to 30%, namely 15% at the Quebec level and 15% at the federal level, and are limited to $1,500 per fiscal year, which represents a $5,000 subscription for shares of the Fonds de solidarité FTQ. These shares can be held in an RRSP at the Fonds de solidarité FTQ and allow you to benefit from the tax credits, in addition to the RRSP deduction from your income. These shares can also be held in a non-RRSP account at the Fonds de solidarité FTQ. In this case, you can only claim the tax credits. Thus, by subscribing for shares of the Fonds de solidarité FTQ held in an RRSP at the Fonds de solidarité FTQ, you can, depending on your tax situation, benefit from more tax savings than the usual RRSP deduction. The Fonds de solidarité FTQ uses the term "RRSP+" to illustrate this enhanced tax benefit.

Information

All the information and data provided are for information purposes only; they are not intended to provide advice or recommendations of a financial, legal, accounting or tax nature with respect to investments. Although they are deemed reliable, no representation or warranty, express or implied, is made as to the accuracy, quality or completeness of this information and data. We recommend you consult your advisor.

FlexiFonds de solidarité FTQ Inc.

The units of the FlexiFonds funds are distributed solely in Québec by FlexiFonds de solidarité FTQ inc., a mutual fund dealer wholly owned by the Fonds de solidarité FTQ. FlexiFonds de solidarité FTQ inc. does not distribute the units of any other mutual funds. Management fees and other expenses may be associated with mutual fund investments. Please consult your advisor and read the prospectus and the fund facts documents before making an investment. The units of the FlexiFonds funds are not covered by the Canada Deposit Insurance Corporation nor any other government deposit insurer. The FlexiFonds funds are not guaranteed, their values change frequently, and past performance may not be repeated.