What to do with your investments when the markets fluctuate

When the markets are volatile, is it better to wait and do nothing or secure your funds until the storm passes?

Are you wondering whether you should withdraw your investments during a stock market downturn? Thinking of securing your investments before prices plummet further but afraid of missing the boat when the market recovers? If so, we get it!

We all wish we could see into the future and invest accordingly. While it's no crystal ball, we do have some advice to help you make decisions that are right for you.

Don't try to beat the markets

Faced with market volatility, you may be concerned about suffering a big loss. That's perfectly normal. When we invest our savings, we want to make as much money as possible without losing a dime.

In these situations, the most important thing is to avoid letting your emotions dictate your financial decisions. Try to think rationally and remember that decisions made in the wake of a sharp downturn may cost you in the long run.

"Don't try to anticipate the markets; they will always be one step ahead of you!

You can look at historical data to see how markets have reacted to different crises over time. Understanding these trends can help you make decisions about which products to invest in."

- Sébastien Lafontaine, FlexiFonds mutual fund advisor and financial planner

My portfolio has dropped by 10%. What should I do?

History has taught us that when stock markets are down, it's generally best to leave your money where it is. If possible, you should even invest more! A slump is the best time to invest.

Skeptical? Let's take a closer look at three scenarios.

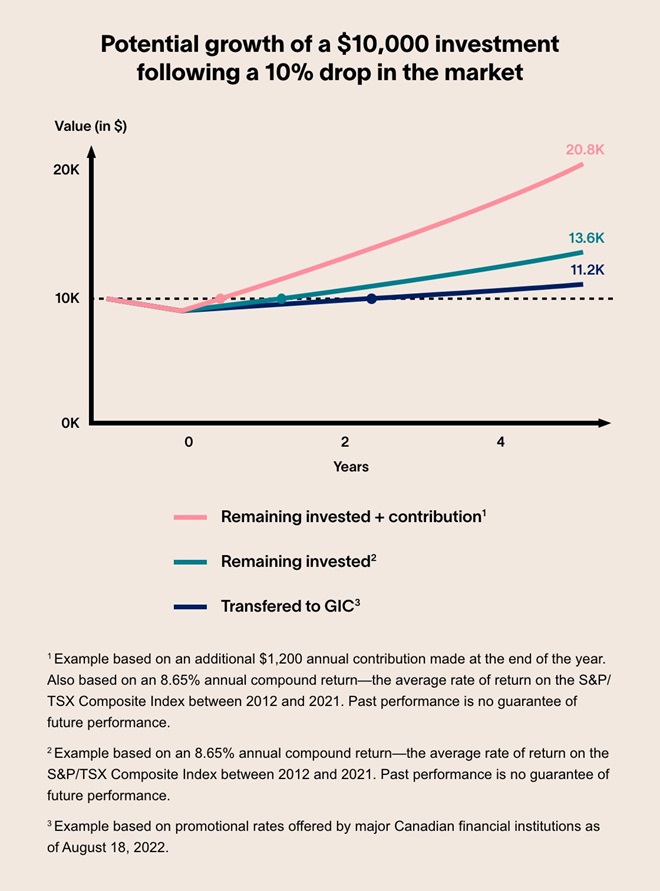

The following graph shows a $10,000 investment that has dropped by 10% since being invested in the stock market (tracking the S&P/TSX index).

The decline occurs at year 0. Three possible reactions are illustrated:

- Leave the investment alone and invest more each year in the fund tracking the S&P/TSX index.

- Do nothing with the fund tracking the S&P/TSX index, without investing further.

- Withdraw the funds and transfer them to a guaranteed product, without investing further. The withdrawal results in a $1,000 loss, leaving the saver with a $9,000 investment.

Five years later, there are three different outcomes:

- Given the additional $1,200 contribution, it takes less than a year for the investment to regain its initial value of $10,000. After five years, the saver who continued to invest has $20,758.45.

- It takes more than a year for the investment to regain its initial value of $10,000. After five years, the saver who did not move their money has $13,626.71.

- It takes over two years for the investment to regain its initial value of $10,000. After five years, the saver who withdrew their investment has $11,215.64.

Withdrawing your savings can result in a loss

If you sell your stocks when the market goes down, you turn the possibility of a loss into a reality. What's more, you miss out on a likely upturn after the worst of the crash, along with greater potential gains in the long term thanks to compound interest.

Markets are cyclical and, historically, stock prices have always trended up over time. It's therefore unwise to withdraw money that you don't need in the short term.

Ask yourself the right question!

To keep you grounded during the stock market's movements, it's important to ask yourself questions about your financial goals.

"The main question to ask yourself is: When will you need your savings? In one year? In three years? In 20 years?

Saving for retirement is not a one-year project; it can take two or three decades! Of course, if something comes up and you need money fast, you can withdraw what you need—but not your entire savings."

Sébastien Lafontaine

If your retirement is still 10, 20, or 30 years away, you have plenty of time to take advantage of market upturns and let your savings grow. No need to worry about short-term fluctuations! However, if you plan to pay yourself a retirement income in the next one to five years, now may be a good time to secure part of your savings.

The choice of product will always depend on your time horizon (i.e., the period of time you expect to hold an investment before you need to use the funds) and your investor profile. It's important to understand that there are a variety of financial products that can suit different investment needs. A guaranteed product, such as a guaranteed investment certificate (GIC), is no better or worse than a mutual fund or an exchange-traded fund (ETF), as long as you diversify your portfolio so you can respond to market ups and downs as needed.

FlexiFonds mutual fund advisors know the stock market inside out.

In a bear market, selling often means taking a loss. Our FlexiFonds mutual fund advisors are just a phone call away and can help you manage your FlexiFonds investments. With their advice and expertise, you can avoid making choices that will cost you more than you think.

1-833-383-2121These articles may be of interest to you

The example takes place over five years to compare the stock market with the GIC market, which has a five-year time horizon. The 4.5% rate of return is the rate offered by various financial institutions as of August 18, 2022.

The tracking index is the S&P/TSX index, the main index on the Toronto Stock Exchange. It tracks approximately 250 of the largest publicly traded companies in Canada.

Clarification: Since the market has experienced significant swings in recent years, the annualized return of this index over the last 10 years is used in the example to give a more sober view of recent market performance. The 10-year annualized return of the S&P/TSX index is 8.65%* as of December 31, 2021.

To accurately represent the current state of the guaranteed product market, the period 2022–2026 was selected for the GIC data to justify the comparison of two different periods (2012–2021 vs. 2022–2026).

*Note that market performance is not guaranteed, stock values change frequently, and past performance may not be repeated.

Information

All the information and data provided are for information purposes only; they are not intended to provide advice or recommendations of a financial, legal, accounting or tax nature with respect to investments. Although they are deemed reliable, no representation or warranty, express or implied, is made as to the accuracy, quality or completeness of this information and data. The opinions expressed should not be construed as a solicitation or an offer for the subscription or sale of shares of the Fonds de solidarité FTQ or the units referred to herein and should not be viewed as a recommendation. We suggest you consult your legal advisor.

FlexiFonds de solidarité FTQ Inc.

The units of the FlexiFonds funds are distributed solely in Québec by FlexiFonds de solidarité FTQ inc., a mutual fund dealer wholly owned by the Fonds de solidarité FTQ. FlexiFonds de solidarité FTQ inc. does not distribute the units of any other mutual funds. Management fees and other expenses may be associated with mutual fund investments. Please consult your advisor and read the prospectus and the fund facts documents before making an investment. The units of the FlexiFonds funds are not covered by the Canada Deposit Insurance Corporation nor any other government deposit insurer. The FlexiFonds funds are not guaranteed, their values change frequently, and past performance may not be repeated.