Understanding key documents when investing in a RRSP

Here's a guide to the principal documents you should be familiar with when you invest in a Fonds RRSP.

When you contribute to an RRSP, with the Fonds or with another financial institution, you will receive a number of tax and legal documents. These include the fund overview, quarterly and annual statements, RRSP receipts and the relevé 10 and T4RSP slips, to name a few. The terms might appear a little incomprehensible to you, but it's really not as complicated as it looks. Here's what you need to know to have a better understanding of how your money is being invested as well as what you need to include with your tax returns.

Make informed decisions before investing

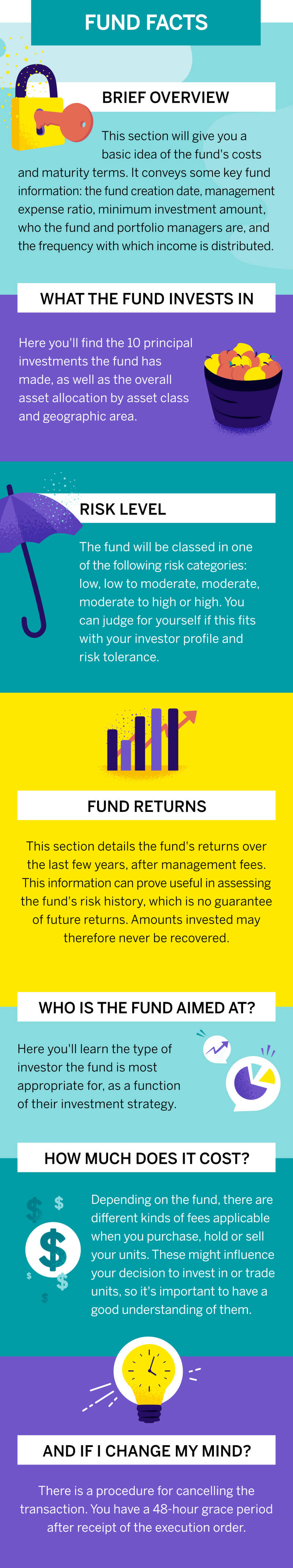

Fund facts

The fund facts document provides a clear and condensed summary of a mutual fund's main characteristics. It's the industry standard and must be provided by the financial institution, pursuant to regulations under the Autorité des marchés financiersAttention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab.* (in French). You should familiarize yourself with it before investing in a mutual fund, or if any changes arise in how such a fund is managed. It's available on the web site of the financial institution you are dealing with, but you can also ask your group savings representative for a copy. Here are the main sections you need to look out for:

If you would like to learn more about the fund, you can find detailed information in the fund prospectus, available upon request from the financial institution or from your group savings representative.

Ready to invest? Here are the documents you will receive once you've placed your order.

Understanding your returns

Quarterly and annual reports

If you choose to invest in a mutual fund, you will receive, quarterly and annually, a personalized document detailing your investment returns as well as the total portfolio value at the end of the reporting period in question. You'll also find documents describing the distribution of capital gains, weighted as to shares, bonds and cash, as well as the fund holder's transaction history.

Checking over these statements is important because it lets you follow the evolution of your investment returns. In light of this information, or in case changes to your personal situation have an impact on your savings, you can review your investments with help from your group savings representative. Normally these statements are available on the online account provided by your financial institution.

Remember that:

- Even if the fund composition, risk level and fees are generally fixed, returns can increase or decrease from one period to another.

- Management fees are deducted from returns, and annual returns can be affected by unforeseen economic or financial events , like major fluctuations in equity markets.

- Unlike mutual funds, the Fonds de travailleurs announces the value of units to shareholders twice a year only, in accordance with its specific legal frameworkAttention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab..

Completing your tax returns

Here are some of the tax slips you might receive if you invest in the Fonds RRSP. Note that this list is not complete: you may receive additional slips of different kinds according to your personal situation and tax status. If you have any questions, don't hesitate to call your personal finance specialist!

The RRSP receipt

This receipt is issued if you purchased FlexiFonds mutual funds. You can use it to complete your tax return as it contains the information the government needs to manage your RRSP deductions.

This document effectively sums up the transactions within your RRSP account, such as:

- New contributions

- Transfers from an investment account

- Transfers from a RRIF

- And also estate settlements

In the first two cases, the « transfer under » box remains empty, whereas in the two banners the designation « 60L » appears.

These slips are generated for each RRSP account and for each contribution type. According to your situation, you might very well receive several! They can be mailed to you or may be available online for a paperless solution, as is the case with FlexiFonds. You will receive them twice a year, in January for contributions for the previous year, and around mid-March covering the first 60 days of the year.

Note that you can request that deductions on contributions made during the first 60 days of the year apply to your return of the current tax year or that of the previous tax year.

The relevé 10

This tax slip (in French) is issued by the Fonds de solidarité FTQ. It makes you eligible for tax credits specific to the Fonds, namely 15% for Québec and 15% federal on a maximum annual amount of $5000**. These amounts are added to RRSP tax deductions. The documents are sent by mail or are available on the investor's online account. Two copies are issued: one for the federal government and one for the account holder.

Remember:

- The relevé 10 covers two items in two sections: relevé 10 (tax credit) and RRSP receipt (tax deduction).

- If you haven't reimbursed your HBP or your LLP, the relevé 10 will state the special tax penaltiesAttention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab.Attention, this link will open a new tab. on the tax credit. The annual amount not reimbursed can be added to your income, thus raising your tax payable.

- The relevé 10 is issued starting in January. You may receive one for the first 60 days and another for the rest of the year, depending on the number of transactions made during the year.

The T4RSP and the relevé 2

If you make a withdrawal from your RRSP you will receive a T4RSP: Statement of RRSP income. This document details your income in retirement as well as any income deducted at source on these amounts. It provides a summary of regular withdrawals, HBP and LLP withdrawals, refunds of excess contributions, transfers on breakdown of marriage or common-law partnerships, or estate settlements.

You need to attach this document to your federal tax return, as these amounts may be added to your income. As a resident of Quebec, you will also receive a relevé 2 (in French): Retirement and pension income, which needs to be attached to your provincial tax return. The relevé 2 provides the same information as the T4RSP, except for items concerning transfers of assets after a separation or divorce. It may be produced by the issuer of an RRSP or a RRIF, for example.

These different documents and slips provide you with an excellent overview of your investments. This will also help you adapt your investment strategy in step with how your life and your goals evolve. As far as tax slips are concerned, they are not only necessary for completing your tax returns properly, but also for benefiting from potential tax deductions and credits you may be entitled to.