Are young Quebecers saving savvy?

Life is full of firsts: your first car, first home . . . But to bring these projects to fruition, you need to do more than dream!

In collaboration with Léger, the Fonds de solidarité FTQ conducted a survey of 1,506 Quebecers aged 18 and over. The goal was to learn more about their personal finance habits.

Your first car, first home . . . Life is full of firsts! But turning those big plans into reality may be more difficult than you think. Do young Quebecers have all the facts when it comes to investing their income? What kind of challenges are they facing today?

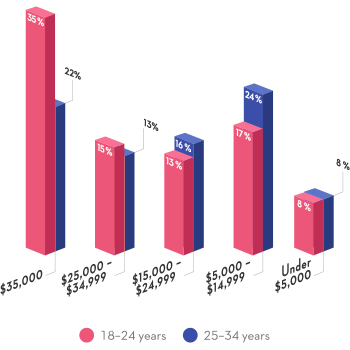

How much do young people think they need for a down payment?

While young people are often criticized for having their heads in the clouds, they seem to have realistic expectations about down payments. Survey results also revealed that 70% of Quebecers under 35 plan to buy property rather than rent.

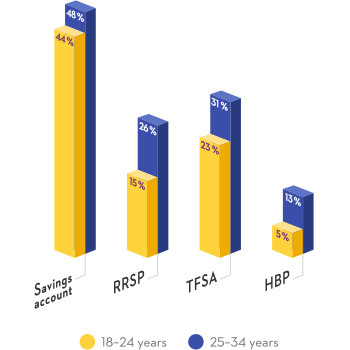

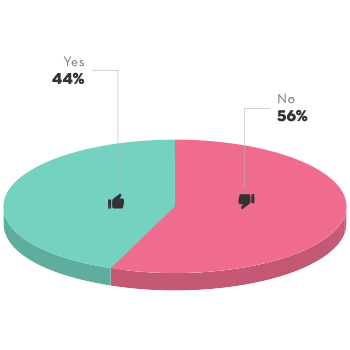

Are they familiar with financial tools?

While many young Quebecers hope to become homeowners, few of them have heard about the HBP. If you're thinking about buying property, make sure to consider this invaluable program, as it allows you to withdraw funds from your RRSP to use as a down payment. Food for thought: while 5% of respondents under 25 said they knew about the HBP, 3% claimed they had heard about the DCDBD—a fictitious acronym created for the survey.

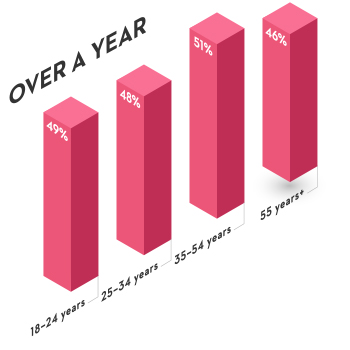

How often do they meet with their financial advisor?

Adults under 35, much like older generations, seem to be divided when it comes to consulting with a financial advisor. In fact, most would rather visit the dentist than open up to an investment expert.

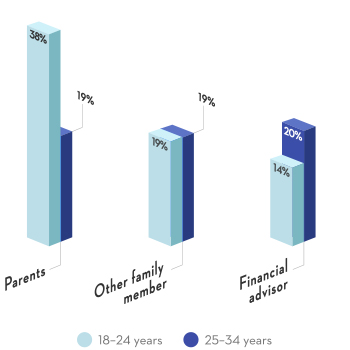

Who do they look to for financial advice?

When it comes to saving and investing, young Quebecers have a family-first attitude. They tend to seek out sage advice from their folks—and the Internet! Over the past year, 60% of Quebecers under 35 browsed the web for answers to money-related questions.

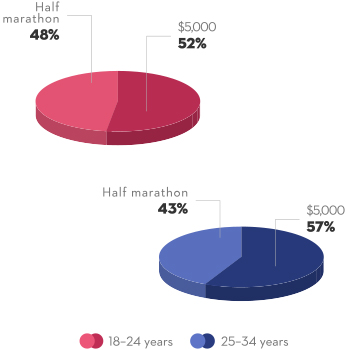

Do they believe they can save $1 million for their retirement?

Many feel that a luxurious, million-dollar retirement in the tropics is a pipe dream. However, nearly half of respondents under 35 are confident that they can save this formidable sum for their golden years.

How do they feel about their saving ability?

Quebecers under 35 seem slightly more optimistic about running a 21K! But just like a trainer can help you run a half marathon, a financial advisor can help you save more than you thought possible. Investing $5,000 annually for 40 years at 3% interest = $377,006.30. That's far from the million-dollar mark!