RRSPs: What you need to know

Do you know what an RRSP is and what it can do for you?

Whether through your employer, family, or friends, you've probably heard about the registered retirement savings plan (RRSP). But what exactly is it and how does it work? Here's what you need to know about RRSPs and how they can make your money work for you.

What is an RRSP?

An RRSP is a financial tool that provides an incentive to save for retirement. It can also be used for other big projects, such as buying a home through the Home Buyers' Plan (HBP) or going back to school through the Lifelong Learning Plan (LLP).

What are the advantages of an RRSP?

Save taxes now and invest with flexibility

When you contribute to your RRSP, the amount is deducted from your taxable income. This directly reduces your tax bill. For instance, a person with an income of $57,376 to $106,495 in 2025 is taxed at a marginal rate of 36.1 percent. If they contribute $5,000 in a RRSP with FlexiFonds products, they will save $1,805 in taxes.*

The advantages of the RRSP+ at the Fonds de solidarité FTQ

By choosing the RRSP+ at the Fonds de solidarité FTQ, they will receive an additional tax credits of 30 percent.** When combined with regular RRSP deductions, the tax reduction increases to $3,305. Their $5,000 in savings will have cost them only $1,695.

To find out how much you personally can save in taxes, use the Fonds de solidarité FTQ's tax savings calculator. However, keep in mind that if you withdraw funds from your RRSP other than through the HBP and LLP, you still have to pay tax on the amount withdrawn.

Defer taxes

An RRSP lets you defer the tax you pay on your income. The advantage is that your current tax rate is probably higher than what it will be when you retire. So, by deferring the taxes, you should end up with a lower tax bill than what you received as a deduction when you contributed. In the meantime, the money you invest in your RRSP will grow tax-free.

Make your money work for you

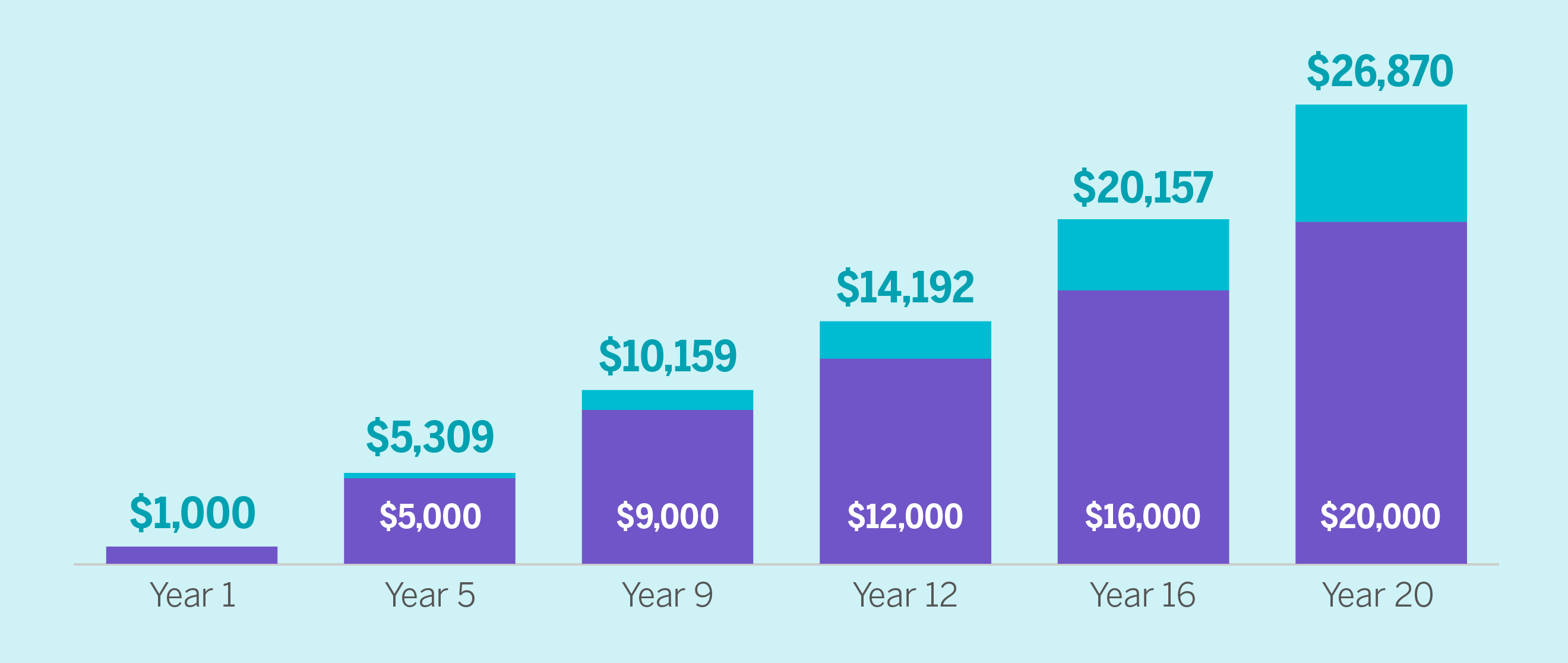

Once your money is in an RRSP, it can generate tax-sheltered profits. For example, if you contribute $1,000 a year over 20 years, you will have invested a total of $20,000.

Let's say you have a constant return of 3 percent per year during this period; this interest will be added to the initial amount and grow. After 20 years, you would have $26,870 in your RRSP—$6,870 more than the amount you initially invested. To find out how much your personal future investments could be worth, use the Fonds de solidarité FTQ's future value of investments calculator.

Contribute to your spouse's RRSP

You can also contribute to your spouse's RRSP. Depending on your situation, this may be a worthwhile retirement withdrawal strategy to pay less tax once you retire. If your income is much higher than your spouse's, your tax rate will likely be higher than theirs. With pension income splitting, you can distribute your retirement income and that of your spouse more evenly so as to reduce both your tax bills. You can do this by contributing to your lower-income spouse's RRSP.

RRSPs: Key takeaways

Age 18

From this age onward, your annual contribution can exceed $2,000.

Age 71

You are not allowed to hold an RRSP beyond December 31 of the year you turn 71. By this time, you can choose to convert your RRSP into a registered retirement income fund (RRIF).

18 percent

This is the maximum percentage of your earned income from the previous tax year that can be contributed, up to a maximum amount of $32,490 for the 2025 tax year. The limit may vary depending on a number of factors, including unused contribution room from prior years and pension plan contributions.

March 2, 2026

That's the deadline to contribute to your RRSP to reduce your 2025 tax bill. Any contributions after that will reduce your taxes for the 2026 tax year.

Depending on your situation, contributing to an RRSP can pay dividends in terms of both the tax savings and the earnings on your investment. An RRSP can give you the means to achieve your dreams. While contributing early can generate more long-term benefits, there is no ideal age to start. You don't have to have large sums of money to invest—it's always advantageous to add a few dollars to your reserves. The Fonds de solidarité FTQ offers an payroll deductions with the RRSP+ hat can help you put money aside and develop healthy savings habits as you manage your personal finances.

Saving Savvy: Crash courses to learn to love saving

Understanding personal finances is within everyone's reach! For this reason, we've prepared a series of five video courses on various topics, including compound interest, budgeting, savings vehicles, and investment products.

Start the courses*The amounts calculated are estimates that may vary depending on your tax situation.

The subscription for shares of the Fonds de solidarité FTQ may give rise to labour-sponsored fund tax credits. The tax credits amount to 30%, namely 15% at the Quebec level and 15% at the federal level, and are limited to $1,500 per fiscal year, which represents a $5,000 subscription for shares of the Fonds de solidarité FTQ. These shares can be held in an RRSP at the Fonds de solidarité FTQ and allow you to benefit from the tax credits, in addition to the RRSP deduction from your income. These shares can also be held in a non-RRSP account at the Fonds de solidarité FTQ. In this case, you can only claim the tax credits. Thus, by subscribing for shares of the Fonds de solidarité FTQ held in an RRSP at the Fonds de solidarité FTQ, you can, depending on your tax situation, benefit from more tax savings than the usual RRSP deduction. The Fonds de solidarité FTQ uses the term "RRSP+" to illustrate this enhanced tax benefit.

Please read the prospectus before subscribing for shares of the Fonds de solidarité FTQ. Copies of the prospectus may be obtained on the Website fondsftq.com, from a local representative or at the offices of the Fonds de solidarité FTQ. The shares of the Fonds de solidarité FTQ are not guaranteed, their value changes and past performance may not be repeated.

FlexiFonds de solidarité FTQ Inc.

The units of the FlexiFonds funds are distributed solely in Québec by FlexiFonds de solidarité FTQ inc., a mutual fund dealer wholly owned by the Fonds de solidarité FTQ. FlexiFonds de solidarité FTQ inc. does not distribute the units of any other mutual funds. Management fees and other expenses may be associated with mutual fund investments. Please consult your advisor and read the prospectus and the fund facts documents before making an investment. The units of the FlexiFonds funds are not covered by the Canada Deposit Insurance Corporation nor any other government deposit insurer. The FlexiFonds funds are not guaranteed, their values change frequently, and past performance may not be repeated.