Preparing for retirement: Tips for effective planning

Many people look forward to being able to spend all their time as they like once they retire, but financial realities can sometimes ruin that plan. The following tips will help you go into retirement with peace of mind.

Do you wonder whether you're saving enough? Are you concerned you might run out of money in retirement? Are you unsure how to manage your savings once you retire? You're not alone! This new stage in life naturally comes with a certain amount of stress, as well as questions about your financial health. However, there are some simple steps you can take to ensure a smooth retirement.

Answers to your questions

To get an expert's perspective, watch the Q&A portion of the retirement planning webinar given by Sébastien Lafontaine, FlexiFonds mutual fund advisor and financial planner.

Introduction

Taïna Lavoie (TL): That was very interesting! And someone who has more interesting things to say is FlexiFonds' Sébastien Lafontaine, who has a passion for economics and financial markets. He's a mutual fund advisor, a seasoned financial planner and a lovely person all-around! I'm pleased to welcome you… Hello Sébastien!

Sébastien Lafontaine (SL): Thank you, Taïna! Hello everyone! I'd like to take this opportunity to say hello to all the savers listening to us today.

TL: We really appreciate you being here. Yes, and I'd also like to congratulate you, because if you've connected with us today, it's because you're interested in this topic and have questions. And we're here to answer them to the best of our ability. I'm told that we've already received over 300 questions! So, as you might imagine, with time being limited during the webinar, we might not be able to get to everyone's questions. But the great thing is that Sébastien Lafontaine and his entire team at FlexiFonds will be available this afternoon and over the next few days, and the next few weeks, to provide answers by phone or email. Don't hesitate to get in touch with Sébastien and his entire team because, even if each case is unique, people have common concerns, which is completely normal.

Each of you has a unique financial situation and is living a different experience. You may be retiring, or you may have been retired for 5 years, 10 years or 15 years... You may be asking yourself: do I have enough financial resources from different incomes to last throughout my retirement? It's impossible to know when we'll die… How long are we going to live? Are we going to make ends meet? We shouldn't be too stressed about all this, and above all we should be able to anticipate our retirement, which should be happy and pleasant time. Sébastien is here to tell us how.

The importance of good retirement planning

TL: Why should we have a solid plan for retirement?

SL: This is the key question. That is indeed the key question, and it's a question people are asking more and more... especially in light of the aging of the population, about which Mr. Zappa spoke. Three main elements impact retirement.

The first, which Mr. Zappa touched on earlier is increasing life expectancy. But what does increasing life expectancy mean? It means that needs must be met for longer. It means you must accumulate more capital to meet those needs, and in this respect, retirement is a bit like a trip…

TL: A nice trip!

SL: A nice long trip.

TL: Down South, or up North. It doesn't matter!

SL: Wherever you want! It's a 20- to 30-year trip; it can even be a longer trip than that. Therefore, it's essential to pack our suitcases well to enjoy this beautiful getaway from start to finish. Second -- and Mr. Zappa also touched on this -- we can't forget the cost of living. Inflation rates are skyrocketing right now. While we aren't in the 80s, inflation rates are close to 7% in Québec and in Canada. What does this do? It impacts our purchasing power.

TL: And we don't know what the future holds!

SL: Absolutely, and at the same time, it has an impact on our quality of life. We always have to keep that in mind! So, much like when you go on a trip, you have to be ready to face any eventuality. This is the key.

The other element in the equation is the government pensions we'll receive upon retirement. They serve as a good foundation, which is great. However, we can see that our needs won't be fully covered by government pensions. There will be a shortfall. We have to ask ourselves: is the suitcase offered by the governments enough? The answer is obvious, Taïna.

TL: Yes, and you touched on retirement being a wonderful long journey of 25, 30 years… That's a lot of time! When you think about it. We may be retired almost as long as we've been in the workforce!

SL: Exactly!

TL: So we all need a solid retirement plan. I'm really stressed about retirement right this minute. I don't mind telling everyone that I'm 37 years old and...

SL: You're very young, Taïna!

TL: Yes, there's still time to act. As we said with Pierre-Olivier: it's never too late to think about retirement. But, is it normal to feel a little bit anxious?

SL: It's completely normal; it's completely legitimate, Taïna. In line with what you're sharing... I find it interesting, because it relates to what I hear in my daily life, at the office, talking to colleagues... As for people who are close to retirement, they call us and ask: Sébastien, will I have enough for retirement? Am I saving enough? Will I need to work longer? These are the kinds of questions we answer on a daily basis.

As for people who are already retired, they'll say: I'm taking full advantage of retirement so far, but

TL: Am I overdoing it?

SL: Exactly: Could I run out of money later? So we're there to reassure them.

There's also the current market context. Mr. Zappa did a great job explaining this earlier. We can see that the markets are down. We know that there are cycles. Inflation is an important factor that causes additional stress. Which is also completely valid. It makes people doubt the decisions they've made. They ask themselves: Did I make the right decision? And regarding future decisions: Do I change my approach and make a different decision?

At FlexiFonds, we're concerned about these issues, and we have answers to these questions. We're also there to reassure people. But reassuring people means knowing them well, and being keenly aware of their situation. So, to help us answer questions, provide reassurance and help people, we have a plan: the retirement plan.

It is an essential tool to clarify the situation and make decisions easier. So, to make things clear, the plan is there.

TL: Is it like a quiz with questions to answer?

SL: The plan has many steps. We'll come back to this a bit later. First, in regard all these questions, if savers don't have or make a plan, it's impossible for me to answer their questions.

Questions like: How much will I need? Will I be able to take full advantage of it? When will I be able to retire? Is it really at 60? Is it possible? The plan will be able to validate this information. So this is extremely interesting. I see the plan a bit like a GPS…

TL: And we were just talking about travel. How appropriate!

SL: That's it, exactly! The plan provides the main guidelines that will lead us to our retirement destination with complete peace of mind. That's what a retirement plan is.

TL: And hence the brilliant idea of having a good co-pilot when travelling, of being well accompanied.

SL: Always! A good guide!

TL: Absolutely. That's when we turn to you, because these matters aren't necessarily everyone's cup of tea. It's good to have someone who knows about things and gets to know us as we plan for our future and retirement. At the time, it may seem like a mountain to overcome for some people. Some people are new to the subject, and some lack interest. No matter…But what if, concretely, we said: what does a retirement plan consist of? How could we sum it up to the people who are listening?

The basics of a retirement plan

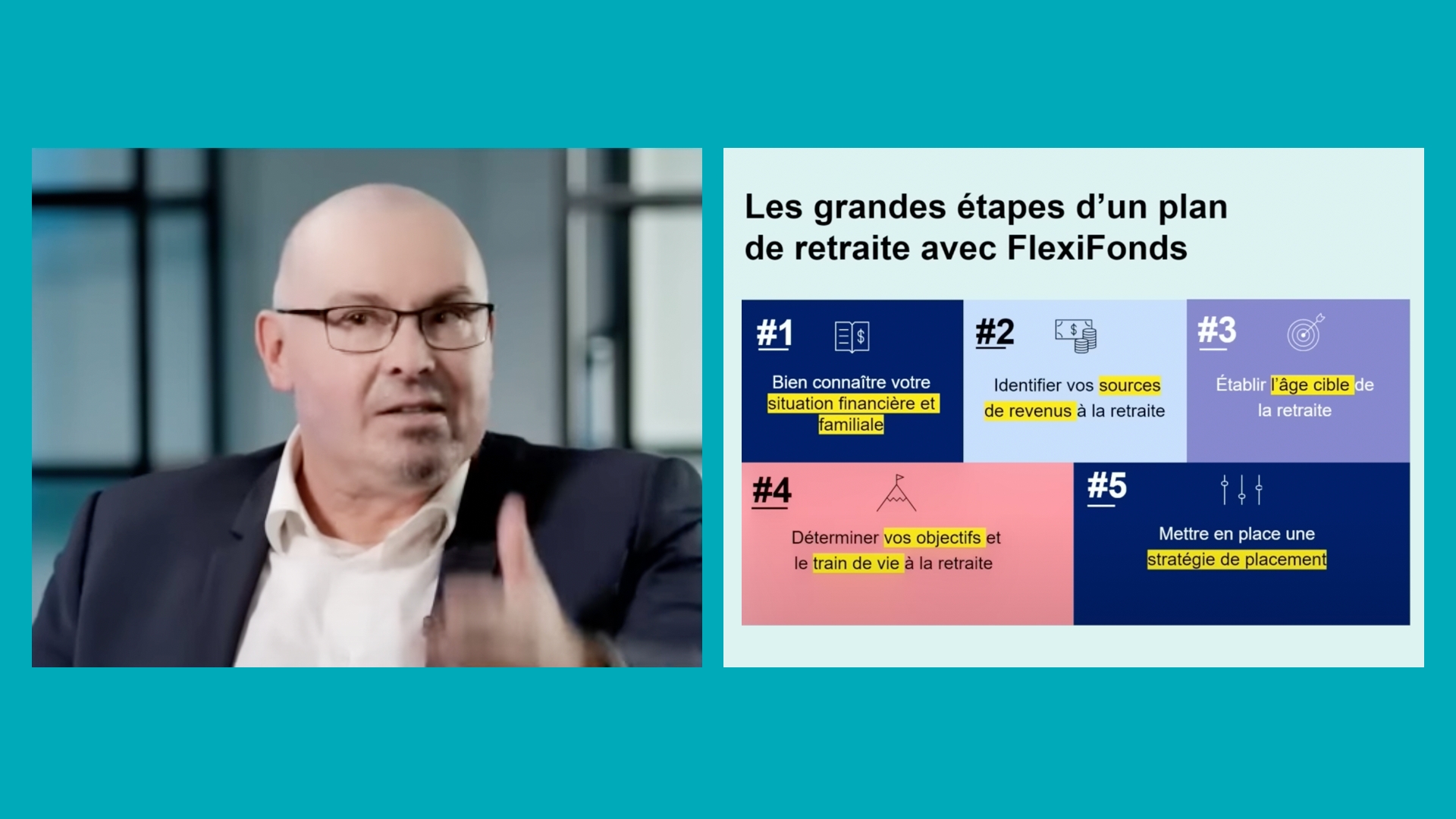

SL: That's a good point, Taïna. A retirement plan may seem like something complex, but it's actually simple. It has five steps. When we approach our savers, that's what we tackle with them. It's what we analyze.

As previously mentioned, the first step is getting to know the saver's family and financial situation. Why? We have to know what we're starting with… I'm a bit like a doctor who gives an examination. Before making a diagnosis, I need to examine your situation and ask you questions.I need to know your marital status. Your personal situation, your financial situation... all this will allow me to paint a picture, and at the same time provide you with recommendations and guidance.

During the second step, we'll identify your various retirement income sources. Some people have a pension fund.Others don't. Some have government pensions. So, we identify all these sources and establish a retirement age.

Does the saver want to retire at 65? Or retire before the age of 60? Retiring before the age of 60 has an impact. Government pensions don't start until age 60, so it's important to take that into account. We'll also determine the saver's desired retirement objectives and the lifestyle. What kind of retirement does the saver want? I recently spoke to a saver who said: Sébastien, I want to go see my boy; my boy is in Europe, so I want to make two trips to Europe to see my grandchildren.

TL: Things are different if a saver plans to stay at home…

SL: Of course! For example, if someone prefers to do volunteer work, work in their garden or spend time outdoors, they may not have the same needs! Another person may want to continue working part-time one or two days a week… So, much depends on each person's situation. We'll set objectives based on individual needs.

And all that will lead us to the investment strategy, which is there to guarantee a comfortable retirement that meets each saver's expectations.

TL: It's quite a process!

SL: Absolutely!

TL: Different steps are involved, and maybe we can provide people with a few more details.

The Québec Pension Plan and the Old Age Security pension

SL: Yes, let's do that since our time is limited. Two steps: the first is identifying retirement income sources... and the second is determining the investment strategy.

Let's look at the various sources of retirement income. Among people watching us, many already receive theses type of income, and we'll be talking about this again later.

Let's start with government pensions. As we said earlier, these serve as a foundation. What do they consist of? First, I'll talk about... the Québec Pension Plan. Let's start with this pension.

TL: It concerns everyone!

Yes, absolutely. It comes from contributions made from your salary: employer contributions, employee contributions… It's an annuity that is paid for life, and let's not forget... that it is fully indexed. Earlier, we were talking about indexation. I'm just making a small callback here. You are entitled to this pension from age 60, but you can postpone it until age 70. So you have choices to make. It is important to mention that, as of 2019... there have been some changes to the Québec Pension Plan. In 2019, the Québec Pension Plan program was enhanced. Essentially, an additional plan was grafted on to the basic plan. Most people have surely noticed this. We are contributing more to the Québec Pension Plan, which explains how the plan could be enhanced. To get information about this and the Québec Pension Plan, we sit down and talk with the saver and look at their statement of participation, which details the amounts they will get at 60 or 65, depending on whether they continue to contribute or stop contributing. So that's what we look at with the saver.

The second element is the Old Age Security pension. You are entitled to it if you are a Canadian resident. There's a caveat, though. You're entitled to it if you've been a Canadian resident for at least 10 years after the age of 18. If you're a resident for 40 years, you'll get the full Old Age Security pension. It's also a lifetime indexed annuity, which is extremely interesting. You are entitled to it from the age of 65, and it can be postponed until the age of 70.

TL: We can see that our life choices, even those we make when we're young, can influence our retirement.

SL: Absolutely, and that's why there are choices to be made. What is important to know is that if you have a higher income, you could be impacted. That is, your Old Age Security pension could be reduced. It's important to take this into account. For the people who are still listening to us, there's something brand new for those who are 75 and older! It's hot off the presses! The Old Age Security pension has been increased by 10% for people 75 and older already receiving the pension.

TL: All in all, things are looking up!

Private pension plans

SL: Yes, indeed! Now let's talk about the second level: private pension plans and employer pensions, or other employer plans that you may have. Let's focus on employer pensions, which are lifetime annuities. These pensions are paid based on the wages you earned and recognized years of service. The characteristics of these annuity are different. They can be indexed or not -- totally or partially -- coordinated or not... That is, the pension amount is higher at the start and decreases at age 65 since it is linked to the Québec Pension Plan. I don't want to go into too much detail here. I want to keep things simple. An employer pension can also be reduced. In the case of early retirement, you could be penalized. This process is called actuarial reduction. What we do with our savers to get more information about this is we ask them for the annual statement of their pension plan, so we can see exactly what's going on.

TL: A global picture!

Other income in retirement and personal savings

SL: Absolutely! Now, let's talk about the other sources of income. Other incomes include rental income, income from the sale of goods or property or income from part-time work. Those are examples of the kind of income you may have.

And last, but not least, are personal savings. What do personal savings consist of exactly? These are the savings you've invested and accumulated in your RRSP, TFSA and investment accounts. Over time, you'll withdraw from these amounts to compensate for and supplement your other sources of income.

There you have it. We've taken a bit of a tour of the different sources of income. To determine these sources, we'll look at savers' statements of accounts and market values and determine the preferred investment types.

TL: That's several branches to assess! The tree keeps growing and growing, depending on each individual case and according to different life experiences. Where personal savings are concerned, not everyone finds it easy to invest money every week, every month... But, in the end, it's so important!

Investment strategy

SL: And all of this brings us to the second point, which is the investment strategy.

TL: What do we do next? We've identified the different sources of income, but what comes next?

SL: We implement the investment strategy, having determined the retirement capital we must accumulate to bridge other sources of income. At this point, we establish the amount to invest to achieve this objective.

We also choose the right savings vehicle. Savers often ask us: Should I contribute to an RRSP, a TFSA or an investment account? We will assess this with you. We will find the right savings vehicle for your situation.

Then, we'll set the investment strategy through an investor profile. We'll base ourselves on this profile, which rests on a few short questions... These questions cover your tolerance to market fluctuations, for example. These are the kinds of questions you'll need to answer and that will help us formulate a recommendation that's in line with your situation. It will be a FlexiFonds investment recommendation you'll be comfortable with and that's tailored to your reality. All this may seem like a mountain to surmount!

TL: We may be repeating ourselves, here!

SL: All this... it's what we do on a daily basis!

TL: You swim through it, like a fish in water!

SL: That's it. We enjoy what we do! But I understand... We're aware of that this topic isn't everyone's cup of tea, so naturally we work hard to make the process simple for our savers.

RRSP or TFSA?

TL: On this topic, someone has asked us: Is it better to contribute to an RRSP or a TFSA?

SL: What a good question! We've touched on this…

TL: I think it's the question everyone is asking themselves!

SL: The RRSP is… Let's distinguish between the RRSP and the TFSA. The RRSP allows us to contribute, to save money for retirement, to take advantage of a tax deduction. And then the amounts, which accumulate tax-free, are withdrawn, at which point they become taxable.

The TFSA, for its part, is an amount that is invested for retirement or for other projects. It does not entitle you to a tax deduction; there is no tax reduction. However, the amounts accumulate tax-free and withdrawals are not taxable.

Is one better than the other? Both have their pros and cons… The bottom line is, if you can have both, then having both is the ideal scenario. On the other hand, if you want a more precise answer, depending on your income, and your tax rate... we'll consider your current income versus your estimated income at retirement. If the current income is higher than the estimated retirement income, we'll recommend an RRSP. If the opposite is true, we'll recommend a TFSA. Those are the main factors. There are other factors, but those are some of the ones we consider.

Investment strategy as you approach retirement

TL: A lot depends on each person, of course, but as I approach retirement, should I keep up a good routine, the sound habits that I've established over the years or should I change my investment strategy at the last minute? Is this a good thing to do?

SL: Good point! There are different lines of thought on this. There are people who say that we should opt for safer investments and secure the portfolio. Here we come back to what Mr. Zappa was talking about earlier: increasing life expectancy.

It's vital that our capital lasts as long as possible. To answer your question, Taïna: Not necessarily... We'll look at the investor profile; we'll consider the investment strategy. Are we still comfortable? Is it still appropriate? Yes? Perfect! We'll continue in the same vein and make adjustments if necessary. But as such, we must not forget the life expectancy element and inflation, which both have impacts.

TL: Quickly, do we need to express an interest if we want to change our strategy? Or, will our Advisor ask us: "Are you sure that's a good idea"?

SL: Depending on the situation, we'll makes recommendations... always on a case-by-case basis. So, in some cases, we may stand fast with the strategy because that's the best option But indeed, we can help the saver review their strategy.

What is FlexiFonds?

TL: FlexiFonds: we talked about it from the outset. Several people know about it and have joined FlexiFonds, who are connected with us. But for the benefit of everyone else, how could we describe the organization? What is FlexiFonds?

SL: That's a good question! FlexiFonds belongs to the Fonds de solidarité FTQ. It is a 100% subsidiary of the Fonds de solidarité FTQ. FlexiFonds shares the same mission as the Fonds de solidarité FTQ. We have the same values and approach. We are there to support the Québec economy, and we are also there to support Québec society, of course.

Our offering consists of investment funds based on different profiles and ESG criteria: environment, social, governance. We are highly concentrated in Québec: 70% of the assets of each of our funds are linked to Québec. We offer different savings vehicles, RRSP, RRIF, non-registered, TFSA accounts to meet different needs.

We have a team of caring mutual fund advisors. A benevolent and objective team. What does that mean, concretely? It means that these are people who will listen to you. People who'll make sure they know your situation well. People who are really close to people, who'll guide them well. Our advisors ensure the suitability of an investment and make sure you are comfortable with it. These advisors are paid on salary. They receive no incentive compensation; that's important to remember! It's a zero-pressure approach to ensure that we respect your pace, and accompany you. We'll be there by your side. So, if you need a little more time, we respect that, but we're there for you to help you make your decision. FlexiFonds, which launched in 2019, has garnered 25,000 savers and over $337 million in assets managed in three and a half years.

I would like to thank our savers who are listening. Theirs is a fine pledge of confidence. We are grateful to them and greatly appreciate having their trust.

TL: I retained one word in particular: benevolence. I loved it when you mentioned that word, and I can confirm, having met you over the past few days; that I feel it too when you speak to us.

SL: How nice! Thanks!

Disbursement strategy

TL: We talked about investment strategy a little earlier. So, we save for X-number of years, we invest for X-number of years… What happens afterwards?

SL: What happens? After the accumulation phase comes the disbursement phase. So, at some point, you must receive your reward. You've saved for a long time; you've made the efforts. After that, you should get your reward…

TL: And not be penalized!

SL: No, of course not! This step is important. You really must optimize the amounts that you withdraw during retirement. We want to make sure that savers have the amounts they need in their pockets but it's important to consider the tax aspect. We want to make sure that we meet their needs, but the tax aspect must be considered. We'll align the order to withdraw or disburse from savings vehicles based on different incomes that are available.

So, for example, government pensions, employer pensions… Many of our savers who are listening to us are surely in this phase. What is involved in choosing the government pension? When should I claim it? We must also determine the amounts to withdraw and when to withdraw them. It's that simple.

TL: It's that simple!

SL: Absolutely!

TL: I like it, because with you things always seem simple!

SL: Keep it as simple as possible!

Audience Q&A

What to do with my RRSP+ when I retire?

TL: That's good! There are people who are listening who have an RRSP+. What do they do in that case?

SL: What do you do with an RRSP+? That's a good question. An RRSP+ as such… People have accumulated and invested large sums in their RRSPs for a long time. What you have to remember is that with the RRSP+, each situation is unique. So, we're going to look at each specific situation. Our goal is to guide the saver and help them make a decision.

The whole FlexiFonds team feels it is important that you fully enjoy your retirement. So that's the mission that the Fonds has set for itself, and that FlexiFonds also pursues.

What you must keep in mind at the time you make a redemption is that you can contribute until the end of the fiscal year in which you turn 64. That is to say that you benefit from tax credits of 30% until that date. On the other hand, if you make a total or partial redemption, you are unfortunately no longer entitled to tax credits thereafter. This is an important point to underscore.

When to convert my RRSP to a RRIF?

SL: While we're at it, let's talk about the RRIF as well, because eventually the time will come when we're going to transfer our RRSP to a RRIF. Special rules apply in this case. The deadline for transferring an RRSP to a RRIF is December 31 of the year you turn 71.

TL: So that's the best time to convert an RRSP to a RRIF?

SL: Not necessarily.

TL: Not necessarily, OK… Let's shed some light on this. Is there an ideal time to convert an RRSP to a RRIF?

SL: That's a good question. The best time is when you want to top up your current income. So, if you have needs, it's clear that your RRSP can be a source of income from which to withdraw the necessary amounts.

On the other hand, you must consider the tax impact of this withdrawal. That is super important. We will also consider the potential impact on your Old Age Security pension, if the amounts withdrawn are too high. We will take into account your life expectancy, the possibility of income splitting... that is, splitting the withdrawals and the amounts with your spouse. So there are plenty of things we're going to look at to make sure you're making the right decision.

TL: Of course, this is all on a case-by-case basis.

SL: Absolutely!

When to cash in my pension from the Québec Pension Plan?

TL: And what about the Québec Pension Plan? Is there an ideal age to claim it: 60, 65, 70? I'm asking the question here…

SL: Let's look at the slide: normal retirement age is 65 for the Québec Pension Plan. Which means that, from the age of 65, there is no penalty. You'll receive your full pension.

On the other hand, if you claim it before 65, it will be reduced; you'll be penalized. The reduction is 7.2% for each year before age 65. That's 36% if you claim it when you're 60. That's significant. Never forget that it's an important, irreversible choice.

If you claim the pension later, for instance, if you claim it after age 65, it will be increased by 8.4% per year, which means 42% if you claim it at age 70. So, while ever case is unique, it all depends on your income, needs and life expectancy, among other things.

What to consider when choosing my disbursement strategy?

TL: Sébastien, there are so many questions about disbursement! We're going to run out of time! Are there other elements to consider when deciding to plan your disbursement strategy?

SL: Yes, the whole tax aspect... The whole tax aspect must be considered. There are tax brackets you must be aware of, because there are impacts… The tax rate is higher above certain thresholds. Income splitting is also important.

So, there are several elements at the tax level that need to be taken into account. I invite you to assess this with a trusted advisor, a qualified advisor. And at FlexiFonds, that's what you get.

Conclusion - Things to remember

TL: That's great! And this leads us to conclude this topic. There is so much information and there are so many tools we could have shared! We could have spent the afternoon together!

If we had to tell people: This is the one thing you need to remember today the thing that matters most...

SL: What you need to remember today? First, plan ahead, as soon as possible. If you are able to do so, plan as early as possible.

Another important element is to invest through automatic debits. Automatic debits allow you to invest continuously, which makes it easier to handle market fluctuations.

TL: That's how I do it; you don't even notice the debits. It feels like it's less of a hole in your budget, and it goes almost unnoticed…

SL: That's excellent; it's the best thing! Next, the most important thing is to be accompanied by qualified people, people you trust, whether you're close to retirement or already retired.

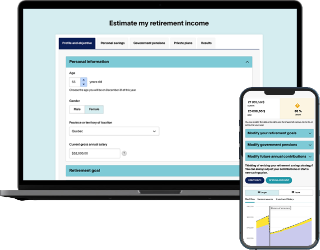

And don't forget, I also want to tell our savers that we have an online retirement calculator that you can use and strongly recommend you use.

I'm very happy with the enthusiasm the webinar has generated. The questions we received bear witness to this. What I find interesting, and what I'm glad to see, is that our savers want to be informed to better understand their finances. On behalf of the entire FlexiFonds team, on behalf of the entire Fonds FTQ team, I want to congratulate them.

TL: And, of course, you and your whole team remain available if people want to contact you.

SL: Absolutely!

Further audience Q&A

TL: That's super! We're going to take a few questions, because we have a few minutes left. We're well aware that some people have obligations after 1 p.m. But for those who are available to stay connected with us, let's continue together for 5 to 10 minutes.

Is it a good idea to withdraw my investments to protect my capital?

TL: Someone has asked us: Sébastien, is it a good idea to withdraw my investments to protect my capital?

SL: Is this a good idea? That's a good question. What I would say to you, in terms of investment strategy, the first thing is to see if you have an emergency fund. Do you have an emergency fund? If you do, so much the better; if you don't have one, I would say that a redeemable GIC is a good option. Then, do you have projects for one year from now? Do you have projects for two years from now? If you have projects in mind for the next year or a year and a half, a GIC is an extremely interesting option.

On the other hand, for the long term, the only way to beat inflation is to have growth in your portfolio; that is, investments in large companies through an investment fund or an index fund. A well-managed investment fund will allow you to beat inflation. It depends on your goals. I recommend it as an emergency fund or for short-term projects, but I don't recommend it for the long term.

TL: I feel like you're going to have a good answer for everything. It's clear that you know your business well!

Is it worthwhile to contribute to an RRSP+ if I have a pension fund?

TL: I have a second question for you: If I have a pension fund like the RREGOP... Is that how it's pronounced? ...can I have an RRSP+, and if so, when?

SL: The RRSP+ can be taken out at any time, but if you already receive an employer pension, you have to check whether doing so is a good strategy for you or whether a TFSA might be your best bet. So, I'd need more information about this saver's situation.

Realities varies, but it's clear that the RRSP+ can be a great option. However, keep in mind that the RRSP+ is currently only accessible with automatic payroll deductions, unfortunately, so, the answer is case specific. I invite this saver to contact us so that we can analyse their situation and make a suitable recommendation.

TL: Absolutely! The invitation has been made!

Is it really necessary to save for retirement?

TL: Is saving for retirement still relevant when economic and environmental issues are more present than ever? Mr. Zappa was talking about how influential this issue can be. He described this situation at the beginning of the conference. Is it always a good idea and relevant to save?

SL: It's always important, and especially in today's markets, which have gone down. Markets are currently discounted, if you will. Are they at their lowest? We don't know. However, the markets is extremely attractive today. Regardless of the cycle, the most important thing is to invest in the market on a continuous basis to enable the accumulation of good capital in order to be able to supplement the sources of income we already have. So, yes, we must save. And, yes, it is a good strategy to save. Despite the economic and environmental challenges... we must save. Let's do it intelligently, let's do it continuously. And I would say that the worst thing that can happen is not being in the markets when the markets go up. That can cost us dearly.

TL: Stability can be a winning choice.

SL: Absolutely!

TL: You have to be comfortable with your choice, though.

SL: Yes, always! You have to be comfortable, absolutely!

TL: Sometimes, security is reassuring, much more than taking risks, withdrawing and reinvesting.

SL: Absolutely!

How can I invest with FlexiFonds?

TL: Wait a moment…If I want to invest with FlexiFonds, how does it work if I am already a Fonds client? Can I do it online?

SL: Yes! You can do it online; that's the beauty of the platform. The platform allows you access your accounts with the Fonds and FlexiFonds, and you can make your transactions at the same time. So, yes, I invite that saver to take the next step, or call our advisers.

What if I don't need my mandatory minimum RRIF withdrawal?

TL: Maybe one or two final questions, if we have the time? I'm withdrawing the required RRIF minimum amount, but I don't need it. What should I do?

SL: First, we should check how old this saver is. If they are younger than 71, they could reconvert their RRIF into an RRSP. They'd get a tax break. However, if they really must withdraw from their RRIF... That's a beautiful problem to have. They could take the money and invest it in their TFSA. They can put it in an investment account, but before doing that, they should consider a registered education savings plan for their grandchildren. There are many things to do. They can give some to their spouse so that their spouse can invest in their TFSA… So, the options are endless.

Is it better to withdraw my RRSP funds and put them in my TFSA?

TL: One last question Sébastien... Should I cash in all my RRSPs and transfer the money to my TFSA?

SL: No! Absolutely not! That's not the right thing to do! You're going to cancel out all the benefits you gained with the RRSP, including the deductions you benefitted from. So I don't recommend this approach.

While in specific situations it can be an option, no direct transfer can occur from an RRSP to a TFSA. You must first withdraw from your RRSP, which has a tax impact, and then you can invest in your TFSA. It's essential to understand this well; it's a question that comes up often.

The TFSA can be an interesting option but on a case-by-case basis. Before making such a decision and withdrawing your funds from an RRSP, call an advisor you trust. It's extremely important.

Where does financial education fit in with the new generation?

TL: Now, I have "mom" question that may be of public interest, because we may also have parents and grandparents listening to us. What's your position on the financial education of the new generation. And I put myself in that category, because economics classes were completely absent in high school, and I graduated from high school about 20 years ago.

SL: Right. We were talking about it with Mr. Zappa earlier. Financial education is so important.

And the first step in financial education is drawing up a budget. That's the first step: making a budget. I know most of us don't. We hear our savers saying that hesitate to make one. But making a budget is pretty simple. List your expenses, enter your income, then compare the two. The important thing is that there be a surplus. You'll better control your expenses, which is extremely important.

Then, in terms of financial education, go get information like you are doing today! The people who are with us today are making the time to get informed; they took their lunch hour to get informed. I think that's great... fantastic.

Things change so often, the rules change so often… So yeah, learn, watch shows, or check in with an advisor who can provide more information. Get the information you need; it's important.

TL: And… maybe avoid your brother-in-law, the self-proclaimed expert, at the next Christmas party!

SL: OK, we love our brother-in-law...

TL: Yes, for other reasons!

SL: We understand each other… But when it comes to expertise, go see the right people!

TL: As concluding words go, you couldn't have said it better, Sébastien. Thank you for being our guest. I'd like to remind all those interested in knowing more about FlexiFonds and how we can be useful to you... That it'll be easy for you to reach us over the next few days. You and your team remain available to everyone.Thanks!

SL: Thanks!

TL: Thanks for being there! Thank you for trusting the Fonds de solidarité FTQ since 1983. Thousands, hundreds of thousands, of people, put their trust in the Fonds. A beautiful proof of this trust is that so many of you connected with us this afternoon.

If you have any comments or suggestions for future information sessions or other activities, don't be shy. We're here for you.

I'm Taïna Lavoie. It's been a pleasure to be with you during the last hour. Thank you for being with us, and above all, take care of yourself. We wish you good health - physical, psychological and financial health, of course. Thank you, everyone! Have a wonderful day!

Why is it so important to plan for retirement?

You've been saving for retirement for a long time, which is why it's easy to think of it as a goal to be achieved. But retirement is anything but a short-term project! Planning is absolutely essential.

Three key factors that affect retirement

Life expectancy is high

Inflation is driving up the cost of living

Government pensions aren't enough to live on

You'll need to support yourself over a longer period

Life expectancy (link in French) is now 81 years for men and 85 years for women. While many factors can affect your life expectancy, your retirement may well last 20 to 30 years! In concrete terms, this means that you'll need to build up more capital since you'll need to support yourself for a long time.

"Retirement is a journey! Depending on your destination and how long you'll be travelling, you need to pack enough—and fill your pockets!—to get the most out of your trip."

Sébastien Lafontaine, FlexiFonds mutual fund advisor and financial planner

The cost of living is increasing, while your purchasing power is diminishing

Although there are times when inflation is higher (from 5% to 7%), the Bank of Canada generally aims to keep inflation at 2%. This drives up the price of consumer goods and eats away at how much your money can buy. And since you never know what the future holds, it's important to make sure your retirement savings can withstand any surprises.

Government pensions provide only a basic retirement income

What retirees need in order to maintain a certain quality of life usually exceeds government pension amounts. Depending on your situation, it's estimated that these amounts may equal as much as 40% of your income. There is therefore a gap that needs to be filled.

What should a good retirement plan cover?

The main steps of a retirement plan

Know your financial and family situation

Identify your sources of income in retirement

Determine the age at which you want to retire

Identify your retirement goals and lifestyle

Decide on an investment strategy

Will you have enough money to retire?

Our planning tool helps you estimate your income after retirement, giving you an overview of your current and future financial situation so you can make the best decisions moving forward.

CRUNCH THE NUMBERSAfter you retire, what's next?

It's time to decide on a retirement withdrawal strategy!

Once you retire, you'll need to withdraw money from your investments. This is called the retirement withdrawal strategy. To get the most out of your savings throughout your retirement years, it's a good idea to have a plan that determines what you'll withdraw and when.

We can help you plan for retirement

FlexiFonds mutual fund advisors are here to help you prepare for retirement. Earning no commission, they offer pressure-free advice and work with your best interests in mind.

Contact an advisor at 1-833-383-2121.

About FlexiFonds de solidarité FTQ

FlexiFonds de solidarité FTQ inc., a wholly owned subsidiary of the Fonds de solidarité FTQ, is a mutual fund dealer duly registered with the Autorité des marchés financiers. FlexiFonds de solidarité inc. acts as the principal distributor of the FlexiFonds funds and does not distribute the units of any other mutual fund.