How to use the Fonds' retirement income calculator

Here’s how to get the most out of the Fonds’ tool to estimate your retirement income.

You'd like to retire in a few years, but you're unsure whether you'll have enough money to do so or whether you'll be able to maintain your current lifestyle. We know these are two common concerns our savers have. That's why we've developed an online planning tool that allows you to determine how much you'll have for this new chapter of your life.

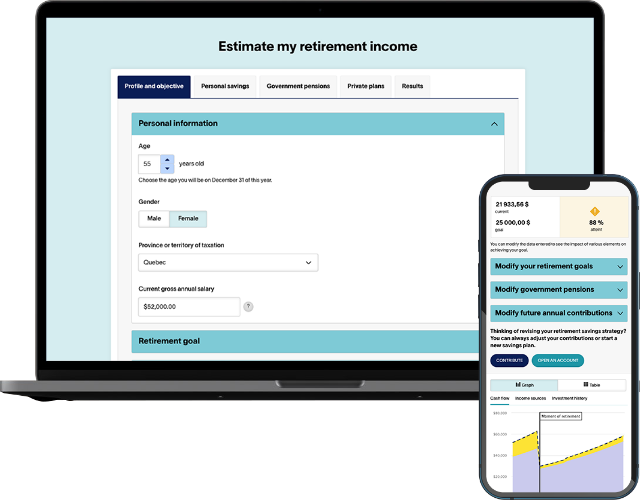

With our retirement income calculator, you can run several tests based on your current situation and obtain a concrete plan to help you reach retirement.

Log in to your online account before starting. It's the best way to keep track of your plan over the years and readjust without having to begin from zero each.

Tip

In order to obtain accurate results and a solid plan, we recommend that you have the following information on hand before using the retirement income calculator:

See it in action

FlexiFonds mutual fund advisor and financial planner Sébastien Lafontaine knows the retirement income calculation inside out. He uses the case of a saver who's 10 years from retirement to walk you through the tool and show you the type of results you can expect.

Your profile and objectives

This first section of the calculator is designed to create a profile of who you are, your goals and sources of retirement income. Your age, gender and desired standard of living in retirement can all potentially impact your future needs. Generally speaking, planning for 70% of your current gross salary is a good rule of thumb.

Tip

Making a budget will help you get a better grasp of your real retirement income needs.

Your savings

The most common sources of retirement income are your personal savings, government pension plans and private plans such as your employer’s pension fund. This section of the calculator allows you to take stock of all your savings in order to build a complete picture of your retirement savings.

Tip

Deferring annuities can pay off. By delaying payments until after age 65, a bonus of 8.4% per year applies, for a maximum of 42% at age 70. This bonus is indexed and guaranteed for the rest of your life!

Your results

The results section is what you've been waiting for! You'll be able to see if you're on the right track or whether you need to course correct in order to reach retirement. This may involve one or several of the following scenarios:

- Increasing your personal savings (we always suggest taking small steps through automatic savings. Small amounts set aside with each paycheque end up making a big difference over the year – and especially over several years).

- Postponing your retirement age (it's not always ideal, but sometimes it's the most realistic choice if you want to enjoy the retirement you've dreamed of).

- Continuing to work part-time to generate additional income. It's a good way to stay active too!

- Reviewing your retirement lifestyle to reduce expenses. A budget is often an unloved tool, but it's an essential one for determining how much money you have coming in and going out.

Tip

Your plan will naturally evolve over time normal and need adjusting along the way. FlexiFonds mutual fund advisors are there to offer you caring support, with zero pressure.

Now you're ready to create your plan!

CREATE MY FREE PLANAbout FlexiFonds de solidarité FTQ

FlexiFonds de solidarité FTQ inc., a wholly owned subsidiary of the Fonds de solidarité FTQ, is a mutual fund dealer duly registered with the Autorité des marchés financiers. FlexiFonds de solidarité inc. acts as the principal distributor of the FlexiFonds funds and does not distribute the units of any other mutual fund.

Trademarks

FlexiFonds, FlexiFonds Conservative, FlexiFonds Balanced and FlexiFonds Growth and the other trademarks displayed on this site are registered trademarks of the Fonds de solidarité FTQ. Other companies' trademarks are used with permission or under license. All rights reserved. Trademark references on this site should not be construed as an implied authorization to use such trademarks.

Access and site availability

The website is the property of Fonds de solidarité FTQ. By using the website, you agree to the following terms of use. You acknowledge and agree that the Fonds de solidarité FTQ may restrict, suspend or revoke your access to or use of all or part of the site, including links to third party sites, at any time, with or without cause, in its absolute discretion, without notice or liability. The Fonds de solidarité FTQ does not guarantee that this site will be available and meet your requirements or that access to this site will be uninterrupted. Availability downtime may occur at any time, without notice, including downtime required for maintenance or technical reasons.

Information

All the information and data provided are for information purposes only; they are not intended to provide advice or recommendations of a financial, legal, accounting or tax nature with respect to investments. Although they are deemed reliable, no representation or warranty, express or implied, is made as to the accuracy, quality or completeness of this information and data. The opinions expressed should not be construed as a solicitation or an offer for the subscription or sale of shares of the Fonds de solidarité FTQ or the units referred to herein and should not be viewed as a recommendation. We suggest you consult your legal advisor.