How do you manage your emotions throughout market cycles?

As an investor, you are sometimes faced with rising markets and sometimes with falling markets. Knowing how to manage your emotions throughout stock market highs and lows is an important skill.

If you've invested your savings in financial products such as stocks, bonds, or mutual funds, you're probably hoping your money will grow. After all, everyone likes to make money, and nobody wants to lose money.

However, risk and return potential go hand in hand. Find out what type of investor you are and what tips will help you cope with fluctuations in your portfolio most effectively, especially when the stock market is down.

Rising and falling financial markets: Avoid the traps set by your emotions

When you see your savings go up, then down, then up again, then down again, how do you feel? It's only natural to go through a range of emotions.

When the stock market fluctuates dramatically, your emotions may lead you to make snap decisions that benefit you in the short term, but that could affect your savings over the long term. For example, if you redeem your stocks or shares during a downturn, you are taking a loss. One way to get some perspective is to remember your savings goals and investment time horizon. This can help you avoid missteps. While every investor is unique, you might identify with this roller coaster of emotions.

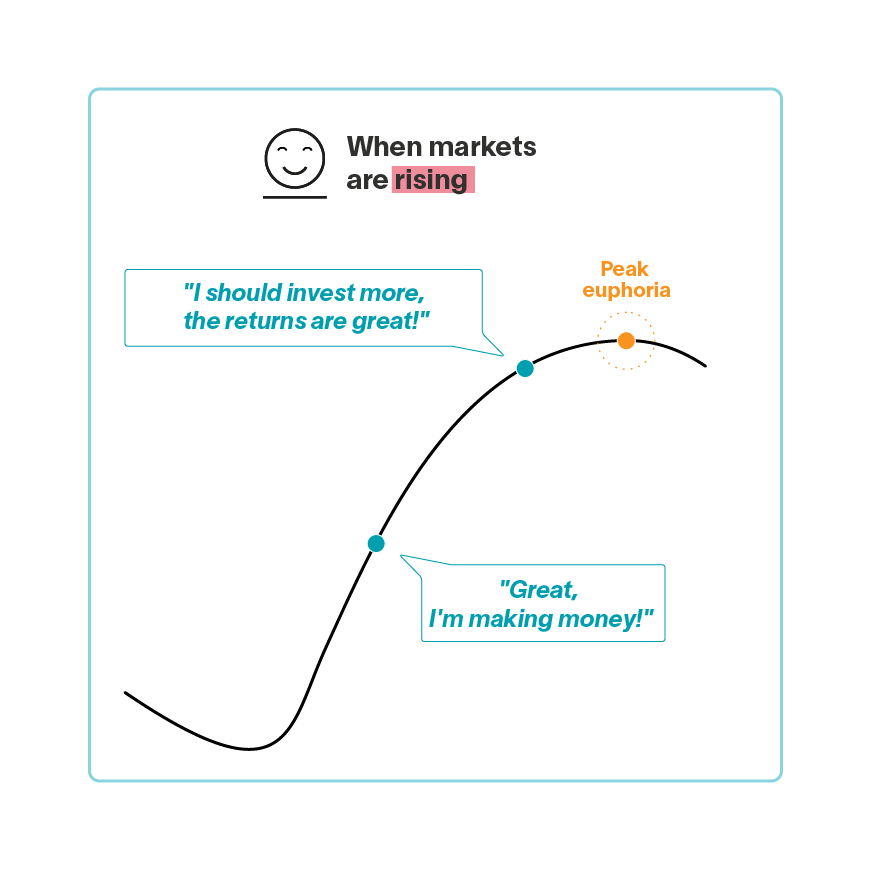

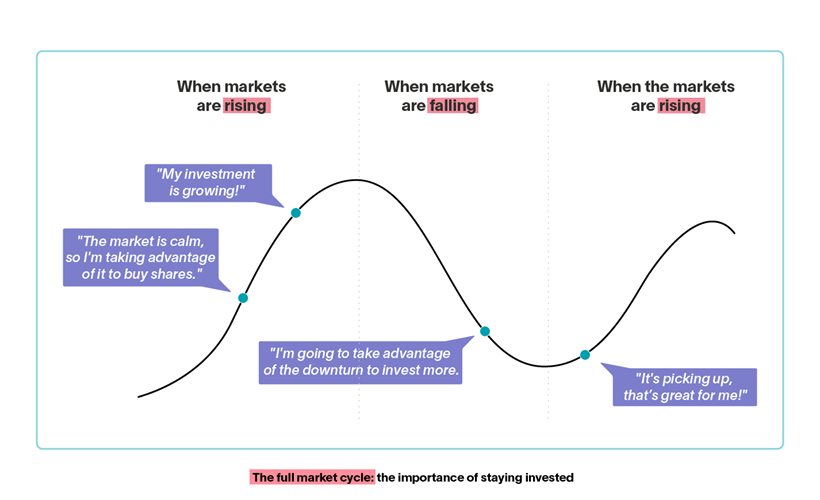

When markets are rising: The euphoria trap

Returns are on the rise. You're seeing your savings grow every day. You're seeing other stocks go up too! You don't want to miss the boat. You get excited. You feel confident!

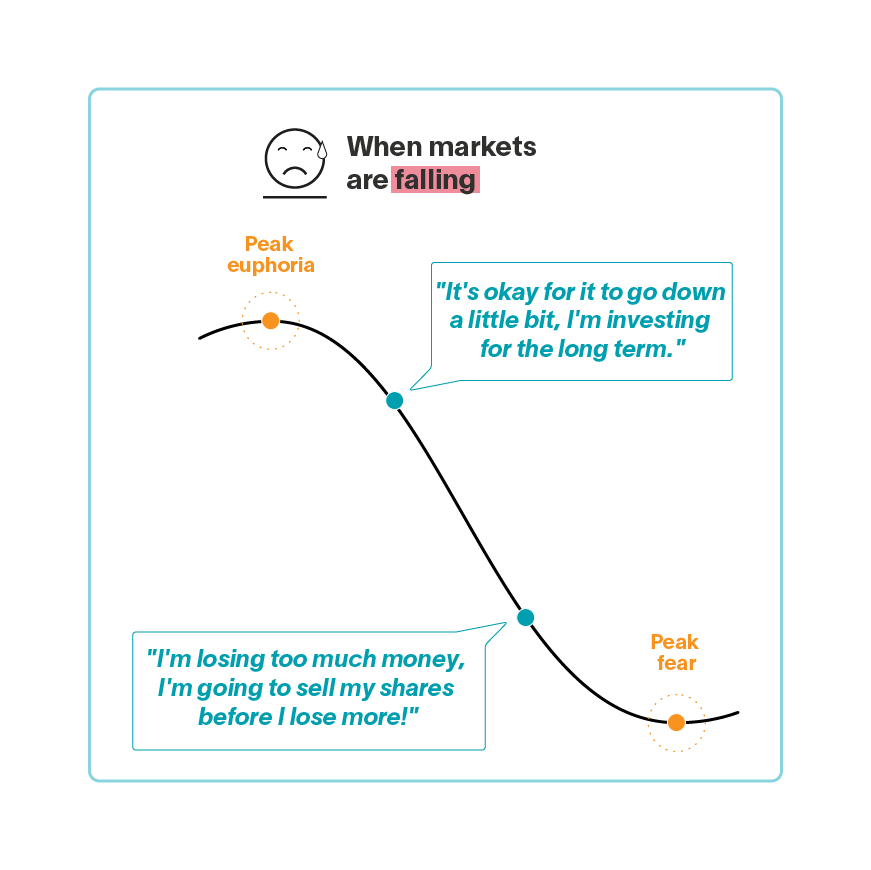

When markets are falling: The panic trap

After potentially making significant gains, you watch your savings stagnate and then decline. You lose the profits you made. Maybe even more. You start feeling uncertain, then panic. You're afraid of losing everything!

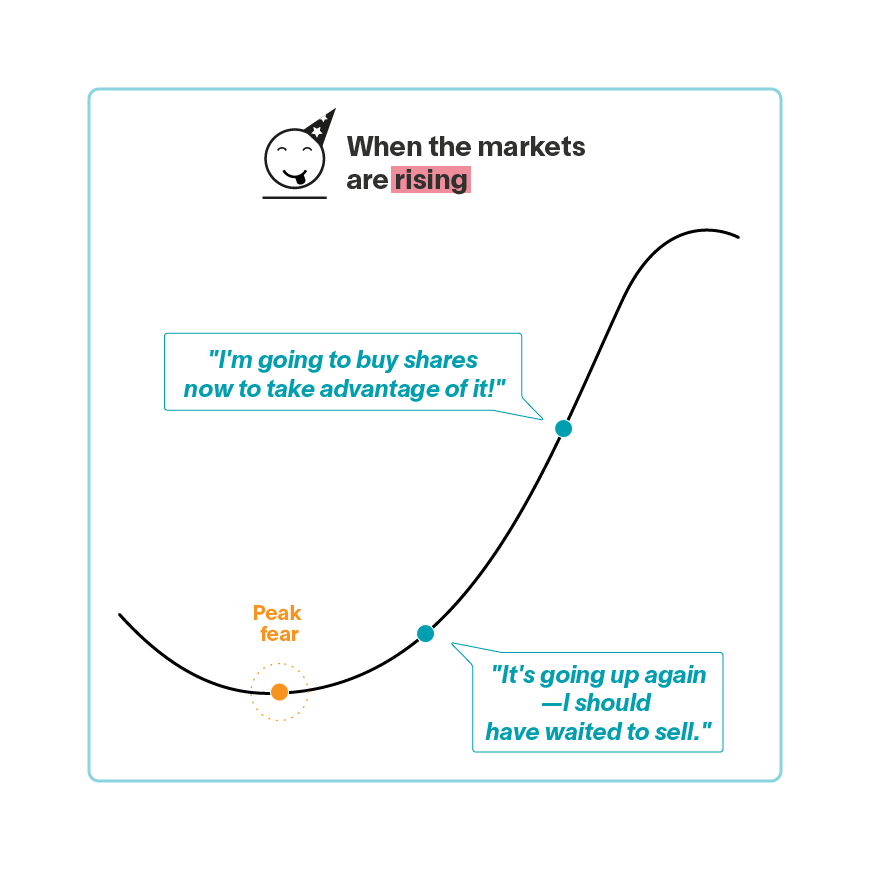

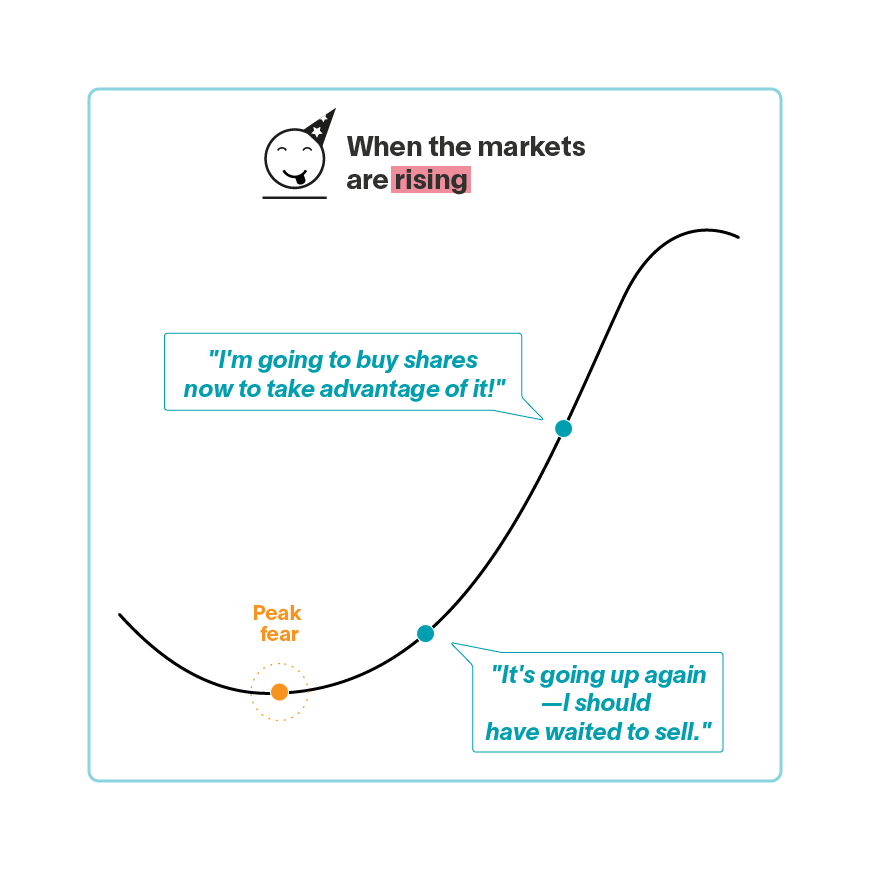

When the markets are rising: The procrastination trap

After undergoing a significant decline, the market tends to recover—just like your savings. If you redeemed your investments, you're now thinking about getting back in the game to take advantage of the new returns. You're optimistic and slowly regaining your confidence!

The full market cycle: the importance of staying invested

It's the nature of markets to go up and down. At some point, the market will reach a peak or trough and start moving in the other direction. The longer you invest, the more fluctuations you may experience. The important thing is to prepare yourself and stay the course. If you control your emotions, you can make your savings grow.

What type of investor are you?

Do you recognize yourself in any of these profiles? Knowing how you react to the ups and downs of the markets can help you learn to manage your emotions and make good financial decisions for yourself—decisions that pay off.

The auto-saver

Your motto: Automate saving so I don't have to think about it

You've set up automatic bank withdrawals to save fixed amounts at regular intervals. Whether the market is slowing down or soaring, you don't pay much attention; you continue to invest with your savings goals in mind.

Tip

Pay a little more attention to declining markets and, if possible, take advantage of the opportunity to invest more while shares are selling at lower prices.

The worrywart

Your motto: Limit losses at all costs

You know that losses are a fact of life when investing, but when faced with a bear market, your emotions take over. You check your investments every day and have trouble sleeping. You prefer to sell your shares quickly to limit future losses.

Tip

Avoid checking your investments on a daily basis; it will only make your worry and anxiety worse. Instead, use payroll deductions with an RRSP+ or automatic bank withdrawals with FlexiFonds mutual funds, which will allow you to save without getting carried away by your emotions.

The optimist

Your motto: The market never lets me down

You have benefited from a booming market for over 10 years, with the main American stock index delivering an average annual return of 12.5%*.[1] Since you have experienced few cycles of declining returns, you might be impatient or unsettled in the face of such a volatile, bearish, and unpredictable market.

Tip

Keeping your money invested when the market is down will allow you to take advantage of the next upturn. Take advantage of this market correction to gauge your true risk tolerance.

The opportunist

Your motto: Always buy at a discount

You know that when the market drops, there are plenty of bargains to be had! You take the opportunity to buy new shares at a discount and invest more liquidity in order to lower the average price of your shares and put yourself in a good position for the possible recovery.

Tip

Use payroll deductions with the RRSP+ or automatic bank withdrawals with FlexiFonds mutual funds to control the cost of your shares, even in a rising market.

Update your investor profile

Experiencing wide variations in the markets allows you to learn more about yourself and gain experience. This is also a good time to make sure that your investor profile is consistent with your true risk tolerance.

Tip for optimizing your presence on the markets: automatic saving with FlexiFonds.

A good way to take advantage of the best days on the stock market and to even out the average purchase price of your units is to set up automatic bank withdrawals with FlexiFonds. In addition to staying invested through the ups and downs of the markets, you'll be better positioned to optimize your return throughout the market cycle.

SET UP AUTOMATIC BANK WITHDRAWALSFlexiFonds mutual fund advisors are here for you. Don't hesitate to contact them at 1-833-383-2121, Monday to Thursday from 9 a.m. to 8 p.m., and Fridays from 9 a.m. to 5 p.m.

Information

All the information and data provided are for information purposes only; they are not intended to provide advice or recommendations of a financial, legal, accounting or tax nature with respect to investments. Although they are deemed reliable, no representation or warranty, express or implied, is made as to the accuracy, quality or completeness of this information and data. The opinions expressed should not be construed as a solicitation or an offer for the subscription or sale of shares of the Fonds de solidarité FTQ or the units referred to herein and should not be viewed as a recommendation. We suggest you consult your legal advisor.