How is the return on FlexiFonds investments calculated?

We'll help you understand how the return on FlexiFonds mutual fund units work, since they fluctuate differently than other types of financial products.

The composition of FlexiFonds mutual funds — 30% of which consist of Class "C" shares of the Fonds de solidarité FTQ — makes these products unique on the market. It also affects their returns: one part fluctuates daily, and one part fluctuates twice a year.

A two-tiered return

All FlexiFonds funds are made up of four asset classes.

- Fonds shares to invest in local businesses.

- Fixed-income securities, which are mainly bonds issued by the Québec government.

- Québec shares from publicly traded companies that are part of the IQ-30 index.

- Global equities for portfolio diversification.

What fluctuates twice a year

FlexiFonds funds are made up of 30% Class "C" shares of the Fonds. A Class "C" share of the Fonds has the same value as a Class "A" share of the Fonds. It can be held in an RRSP+, but doesn't offer additional tax savings or voting rights at the Fonds' annual general meeting1.

The Fonds' Class "A" and "C" shares are not traded on the stock exchange. This is why their respective values do not fluctuate daily. Their new value is generally reported twice a year, namely at the end of the Fonds' fiscal year (on or around June 23) and in the middle of the fiscal year (on or around December 23).

Since Class "C" shares of the Fonds represent 30% of the total FlexiFonds mutual fund mix, 30% of your portfolio remains stable for six months. When the value of these Class "C" shares is assessed, the change will affect all of your FlexiFonds units at the same time. This happens every six months.

What fluctuates every business day

Fixed-income securities, Québec shares, and global equities are bought, sold, and traded every day when the stock markets are open. This influences the value of these securities daily. For example, if a company reports financial results that exceed expectations, demand for its stock could increase and drive up its value. Conversely, bad news can lower a company's stock value.

When the price of the securities held by a FlexiFonds fund in which you've invested goes up or down, so does the value of your units.

That's why FlexiFonds funds are described as having two-tiered returns: one part fluctuates daily, and one part fluctuates twice a year. Now that this concept is clearer, let's see how it affects your savings.

You'll notice that the short-term fluctuations you see every day don't usually affect your medium‑ and long-term savings.

How is my return affected by this two-tiered fluctuation?

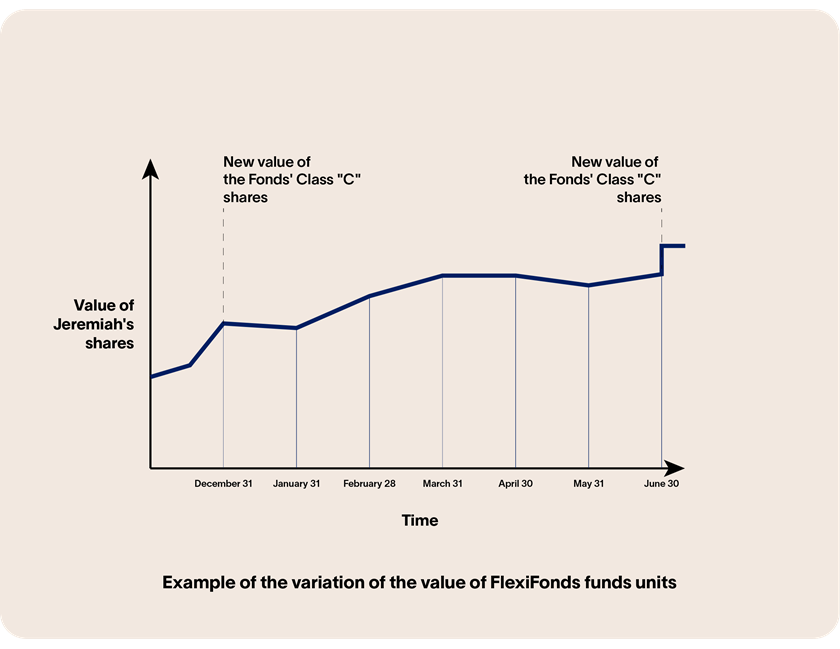

Let's take a look at Jeremiah's case: he holds shares in FlexiFonds funds. From December 1 to May 31, the market goes up and the value of the underlying securities gradually increases by 4%. The value of the other portion—the Fonds' shares—holds steady. Jeremiah might feel that his investment isn't performing as well as others. However, this is just the effect of two-tiered returns! When the value of the Fonds' shares is assessed, they post a 6% return. At this point, he will see the positive catch-up effect on the value of his FlexiFonds units and on his savings2.

In short, understanding the mechanics behind FlexiFonds returns is important because it's always wise to know the ins and outs of the product you're investing in. However, keep in mind that short-term fluctuations, the ones you see every day, don't usually affect your savings over the medium and long term.

A tip for optimizing your market investments: Automatic savings with FlexiFonds

A good way to take advantage of the stock market's best days and to level out the average purchase price of your units is to set up automatic bank withdrawals. In addition to remaining invested through the ups and downs of the markets, you'll also be better positioned to optimize your two-tiered return.

START AUTOMATIC BANK WITHDRAWALSFlexiFonds mutual fund advisors are here for you. Call us at 1-833-383-2121, Monday to Thursday, from 9 a.m. to 8 p.m., and Fridays from 9 a.m. to 5 p.m.

FlexiFonds de solidarité FTQ Inc.

The units of the FlexiFonds funds are distributed solely in Québec by FlexiFonds de solidarité FTQ inc., a mutual fund dealer wholly owned by the Fonds de solidarité FTQ. FlexiFonds de solidarité FTQ inc. does not distribute the units of any other mutual funds. Management fees and other expenses may be associated with mutual fund investments. Please consult your advisor and read the prospectus and the fund facts documents before making an investment. The units of the FlexiFonds funds are not covered by the Canada Deposit Insurance Corporation nor any other government deposit insurer. The FlexiFonds funds are not guaranteed, their values change frequently, and past performance may not be repeated.