8 financial tips to adopt in times of economic turbulence

The current economic situation has created a climate of doubt and uncertainty, especially when it comes to money management. Here are eight tips that will help you adapt your budget when financial conditions are less than favourable.

Even the most seasoned investors can make irrational and impulsive decisions when the economy is down. However, it's normal for the economic cycle to go through peaks and valleys over time. To help you weather this period of instability, here are eight financial tips from financial planner and FlexiFonds mutual fund advisor Sébastien Lafontaine.

01 Stick to a budget

Have you been putting off making a budget? It may sound boring, but it's important for keeping track of where your money is going and seeing where you can make adjustments. And, with the right tool, you can get an even clearer picture of your spending.

Try not to judge yourself when assessing your current expenses. Instead, ask yourself which ones are really important so that you can prioritize them if you need to retool your budget. We all have expenses that aren't necessary, but that make us happy or allow us to pursue our passions, whether that's going skiing, grabbing a latte, or going to the theatre. You don't have to cut these out of your budget if you can afford them, but this exercise will allow you to see how much you're spending on them. Ask yourself what activity or expense brings you the most joy, and reprioritize each category to balance the money coming in and going out.

"Pay yourself first! Saving should be a priority, not an afterthought. Be sure to set aside a certain amount every month or every paycheque and plan how you will invest it to get the best possible return."

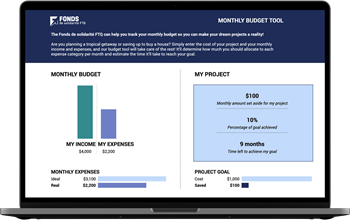

Need a little help with budgeting?

Whether you're a grasshopper or an ant, our free budgeting tool will guide you through creating a budget step by step.

02 Know the difference between essential and non-essential expenses

"Do you really need it?" Answering this question can save you a substantial amount of money by the end of the year. For instance, if you work from home, investing in work clothes probably isn't a priority. However, if you cook a lot (which is a great way to save money!), replacing your broken food processor could be a must.

The same logic applies to buying your lunch, your gym membership, and your streaming subscriptions: essential or non-essential? You know best whether these expenses suit your needs and lifestyle, so you get to decide which ones to keep!

"The idea is to pick and choose between all of these expenses and assess whether what you're paying for them annually is appropriate for your budget and how often you use it."

03 Negotiate and shop around

Taking a step back and examining your lifestyle can help you identify additional opportunities to cut down on your monthly spending. For example, if you're working from home and using less mobile data these days, it might be worth shopping around for a cheaper phone plan.

You may also be able to lower your car insurance premium if you inform your insurer that you're no longer making a daily commute. While you're at it, ask for your contract renewal date. To make sure you get the best rate when it's time to renew, check for deals with competing insurers or use an online price comparison tool. This applies to both your car and home insurance!

Lastly, because groceries account for a large portion of any budget, watch for sales and plan your meals accordingly. This can go a long way toward reducing your grocery bill.

04 Pay down debt

If you follow the previous three steps, all the little savings you've made will start to accumulate, and that can make a big difference in your finances. So, what should you do with the money you've freed up?

"Your priority should be to pay off your debts, especially those with high interest rates, like credit cards or your personal line of credit. Once those are paid off, you'll likely feel lighter and can focus on saving."

05 Start an emergency fund

In these turbulent times, it may be wise to build up an emergency fund with some of the money you've saved. Equivalent to three months worth of expenses, this financial cushion is meant to help you stay afloat in the event of a job loss or unexpected expense, such as a broken appliance. Planning ahead will help you avoid relying on high-interest credit in times of crisis.

"Make sure you have easy access to that money if you need it by investing it in a high-interest savings account or a guaranteed investment that can be redeemed at any time. This will give you the same flexibility as a regular savings account, but with a better return."

06 Save

Even when the economy is slow, saving for your future plans and retirement should remain a financial priority.

"Whether your goal is paying off debt or saving money, get into the habit of setting up pre-authorized debits to help you get there. No amount is too small—start with what you can afford and adjust as needed. This will ensure that a portion of your budget is dedicated to achieving your financial goals."

In addition to providing you with an attractive tax refund, contributing to an RRSP reduces your taxable income. As a result, you may qualify for certain government assistance programs that you were not previously eligible for, or you may be able to maximize benefits you currently receive, such as family allowances.

Some savings plans give you more for your money, like the RRSP+ with the Fonds. If you have the means, optimize your contributions to get the maximum additional savings. For example, to take full advantage of the additional 30 percent in tax savings1 offered by the RRSP+, you would need to contribute $5,000 each year. That's a $1,500 tax credit that you can then reinvest!

07 Avoid withdrawing your long-term savings

Given the current instability of the financial markets, it's best to hold off on withdrawing funds from your RRSP or TFSA. Ideally, these savings should be a last resort. By redeeming your shares or units when the financial markets are down, you risk taking a loss, which is obviously not ideal. While it may seem counter-intuitive, Sébastien Lafontaine says now is actually a good time to invest more.

However, if the above tips don't leave you with enough money to cover your daily expenses, you may want to temporarily suspend automatic transfers to your savings accounts.

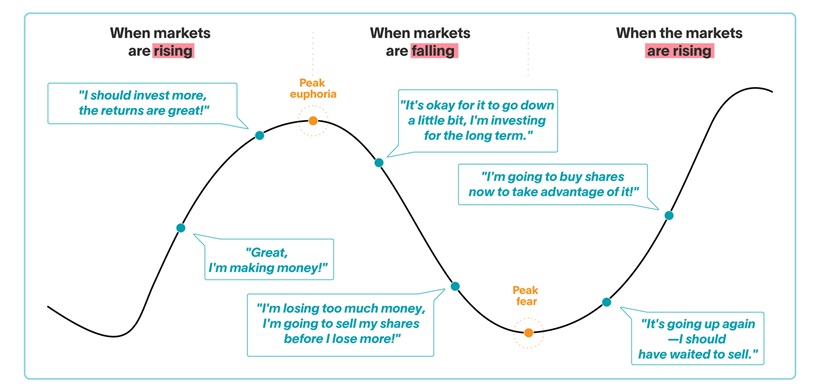

"Don't let your worries get the best of you when you see the value of your portfolio dropping. Instead, try to keep a cool head and avoid making emotional decisions. Remind yourself that it's normal for the markets to fluctuate, and focus on your long-term financial plan."

Our emotions can be our worst enemy when it comes to managing our investments. Learn how they can lead us to buy and sell at the most inopportune time in the article How do you manage your emotions throughout market cycles?.

The full market cycle: the importance of staying invested

08 Consult a professional

Having doubts and worries about money is par for the course, especially when your financial situation changes. Don't hesitate to contact an impartial personal finance professional when you need help. They will be able to answer your questions and help you reassess your strategy with your best interests in mind.

You can also contact your local association coopérative d'économie familiale (ACEF). Their services are free, and it's a great way to get unbiased, confidential advice tailored to your situation. Located in all regions of Quebec, they offer advice on financial planning, budgeting, and debt management.