What is the purpose of RL-10 and RRSP receipt?

Your Relevé 10/RRSP receipt slip has three sections.

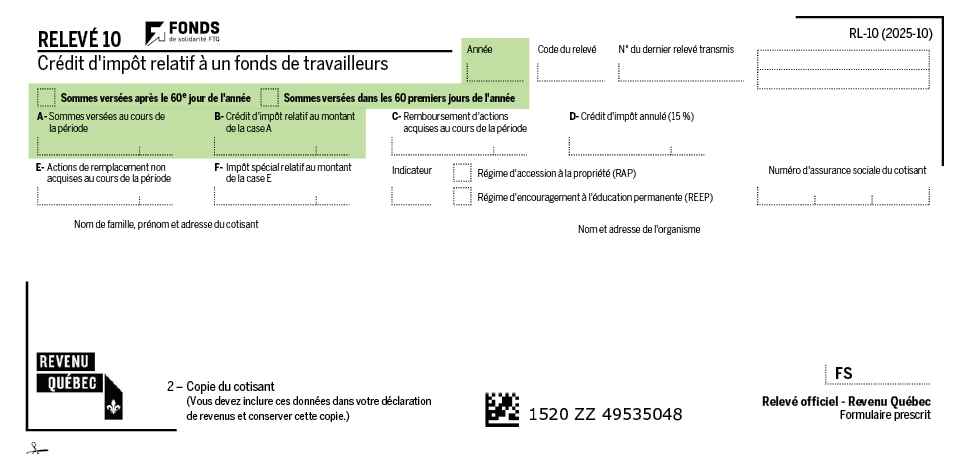

One copie of your Relevé 10.

Keep this copie for your records. You do not need to attach a copy to your income tax returns.

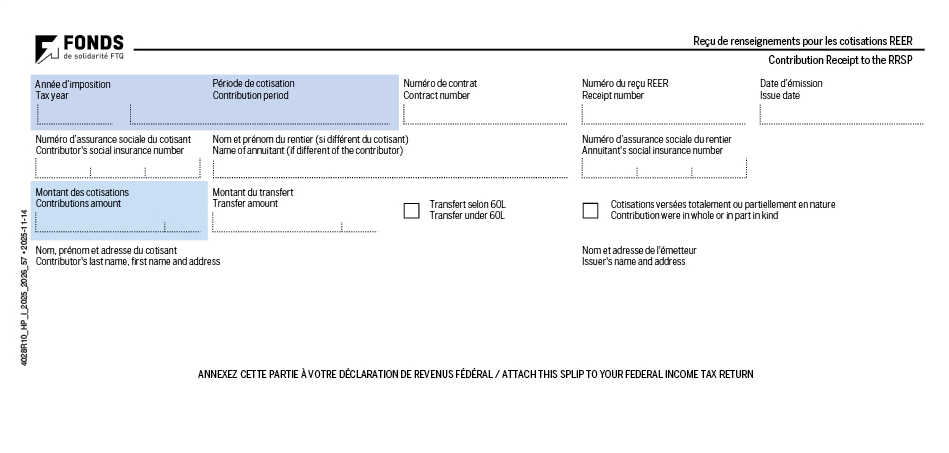

Two copies of your Contribution Receipt to the RRSP (RRSP receipt).

Attach the bottom copie to your federal income tax return, if applicable, and keep the other for your records.

When will I receive my statements?

RL-10 slips are issued twice a year when you make contributions:

- Around mid-January, for contributions made between March 1 and December 31 of the previous year.

- Around mid-March, for contributions made in the first 60 days of the current year.

You must use all slips produced for you to complete your income tax returns (T1 and TP-1).

If your communication preferences are set to paper, you will receive your RL-10 by mail a few days after it is produced.

If your communication preferences are set to digital, you will immediately receive an e-mail notification reminding you where to find your tax slips deposited in your online account.

How do I use a RL-10/RRSP receipt on my tax returns?

To claim labour-sponsored funds tax credits[1]:

Transfer the amount from box A to ...

- line 41300 (Canada)

Transfer the amount from Box B to ...

- line 424 (Quebec)

- line 41400 (Canada)

To claim the RRSP deduction:

Transfer the amount in box RRSP contribution to ...

- line 214 (Quebec)

- line 20800 (Canada)

To designate an amount as an HBP or LLP repayment:

Transfer the amount from the RRSP payment box to ...

- line 212 (Quebec)

- Schedule 7 (Canada)

A useful tip

The most popular tax software programs usually include a function specifically for Labour Sponsored Funds. Look for this function rather than a standard RRSP contribution.

A checklist to keep

We've prepared a checklist to help you complete your tax returns.