RRSP+: Give more to your employees

Offer them to subscribe to Fonds shares so they can get an additional 30% in tax savings¹. A no-fee, turnkey solution.

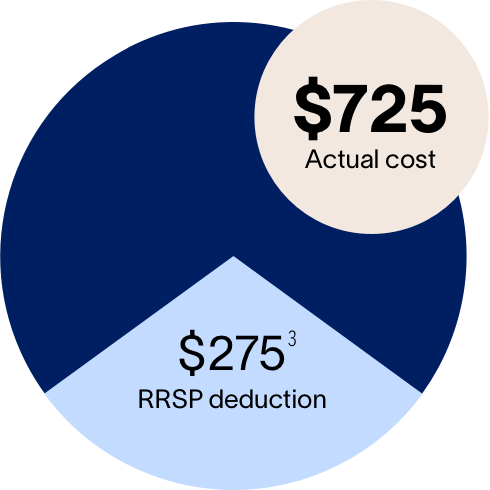

APPLY TODAYTraditional RRSP

$1,000

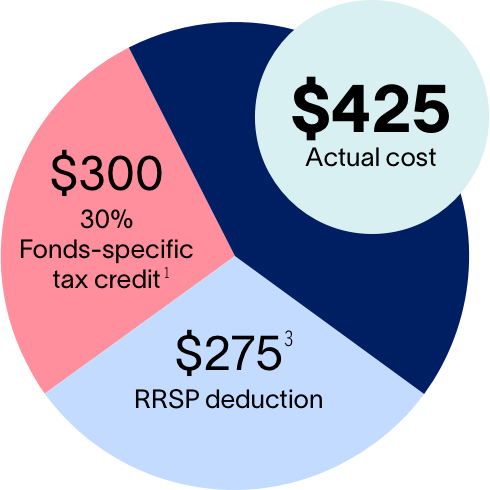

RRSP+ with the Fonds

$1,000

Over 17,580⁴ Canadian employers offer this benefit.

Apply todaySave for retirement and more

By helping your employees save more with the RRSP+, you're lending a hand not only with their retirement plans, but also with life projects like buying a house or going back to school.

Choosing an alternative to the VRSP

An RRSP+ by payroll deduction is simple to set up and enables you to meet the requirements of VRSP legislation while offering your employees more options.

A win-win solution

For employers:

- Adapted to your payroll process

- Easy to manage using the Espace employeur, a secure website

- Includes personalized support service

For your employees:

- Tax savings directly from their pay

- Standard RRSP deduction still applies

- Additional 30% in tax savings¹

Tips and tools for creating a distinctive employee experience

Discover our tips on facilitating employee recruitment and retention while adapting to the realities of Québec SMEs.

Find out more about the RRSP+ by payroll deductions

Learn more about our retirement savings plan giving more to your employees, tools that make setting it up easy as well as concrete examples of tax credits your employees can benefit from, with or without employer contributions.

Most frequently asked questions

Talk to one of our agents

You can reach us at 1-888-385-3723, Monday to Friday, between 8:00 a.m. and 4:00 p.m.

Offer RRSP+ to your employees

Begin your enrollment process online now!

Log in to the Espace employeur

You can manage all aspects of your company's payroll deduction plan online. A wide range of documents for you and your employees is also available on the Espace employeur.