Eligibility criteria for labour-sponsored funds tax credits are as follows:

Residency

You must reside in Québec

Age

Between the ages of 18 and 64. As of the year in which you turn 65, you are no longer eligible for tax credits.

Minimum income

Labour-sponsored funds tax credits are available only if you declare employment income (gross amount) or business income (net amount) of at least $3,501, provided you have not made a buyback for retirement or disability with a labour-sponsored fund.

Maximum income

Investors with taxable income over $112,655 in 2022 will no longer be eligible for labour-sponsored funds tax credits in 2024.

Under federal legislation, a federal tax credit will only be granted if you are also eligible for the Quebec tax credit. Thus, if your taxable income exceeds the threshold, you lose access to the full 30% of credits (15% Québec and 15% federal).

Redemption of a labour-sponsored fund

- Tax credits are no longer available to you from the year in which you redeem a labour-sponsored fund for your retirement or phased retirement.

- If you redeemed from a labour-sponsored fund due to severe and prolonged disability, you are no longer eligible for tax credits for shares acquired after the date of the redemption request.

- You will not be entitled to tax credits for shares you redeem within 60 days of the date of acquisition.

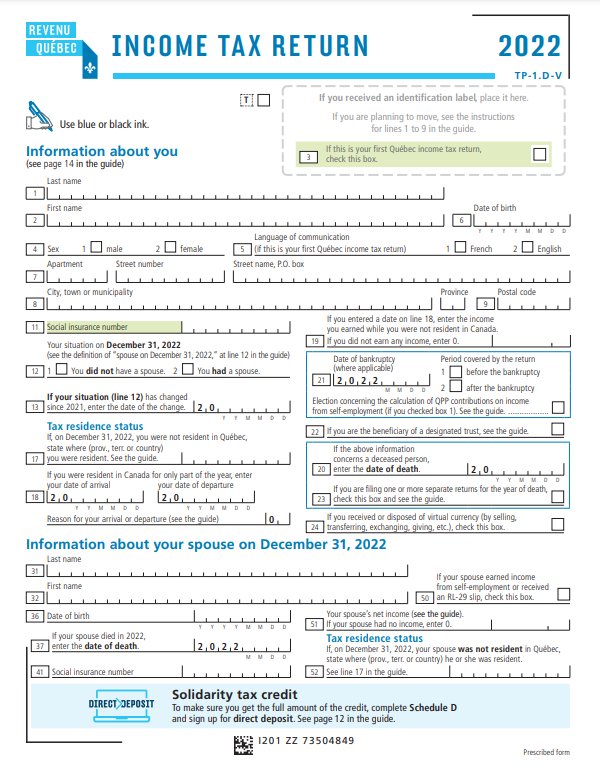

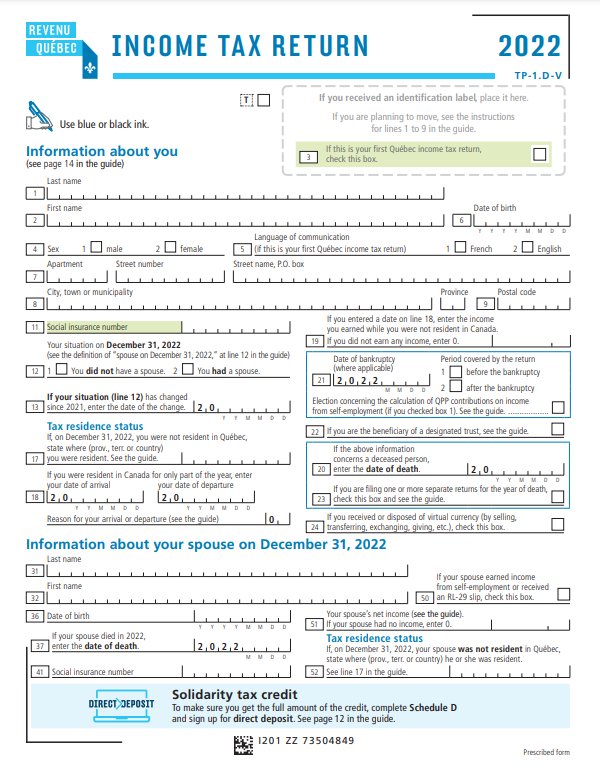

Need help finding your taxable income on your tax return? Here's how.

- Consult your 2022 tax return

- Go to page 3, line 299

- If this amount exceeds the limit set for the tax year in question, you are unfortunately not eligible for labour-sponsored funds tax credits.